Please use a PC Browser to access Register-Tadawul

Can Dow Theory, Developed 100 Years Ago, Still Guide Intraday Trading Today?

PowerShares QQQ Trust,Series 1 QQQ | 624.28 623.89 | -0.19% -0.06% Pre |

Apple Inc. AAPL | 277.89 278.65 | -0.32% +0.27% Pre |

Tesla Motors, Inc. TSLA | 439.58 436.01 | -3.39% -0.81% Pre |

SAUDI ARAMCO 2222.SA | 24.34 | +0.08% |

Tadawul All Shares Index TASI.SA | 10699.79 | +0.70% |

Does Dow Theory Still Hold Value for Today’s Traders?

When discussing the origins of technical analysis, Dow Theory is an unavoidable name. Born over a century ago in the early 1900s, it remains a cornerstone of financial market research and technical analysis. From Elliott Wave Theory and Andrew’s Pitchfork to modern trend trading systems, many methodologies trace their roots back to Dow’s ideas.

A common question arises: Can a theory developed during the era of stock ticker telegraphs still be relevant in today’s fast-paced, algorithm-driven markets?

The answer is: Not only is it relevant, but it serves as the underlying framework that many traders unconsciously rely on.

What is Dow Theory?

Dow Theory, also known as the Dow Jones Theory, was introduced by Charles Dow as a trading method applicable across various financial markets, including forex, stocks, and futures. Interestingly, the name “Dow Theory” wasn’t coined by Dow himself. After his death, William Peter Hamilton and Robert Rhea refined and organized Dow’s trading principles through their market commentaries, giving rise to the theory we know today.

The Core Value of Dow Theory

Dow Theory, initially proposed by Charles Dow and later refined by Hamilton and Rhea, comprises six fundamental tenets that remain highly relevant to contemporary trading practices:

Price Reflects All Information

Whether it’s fundamental changes, market sentiment, or unexpected events, everything is ultimately reflected in price. Modern price action trading essentially validates this principle.

The Market Has Three Movements

Markets exhibit three types of trends: long-term trends, intermediate corrections, and short-term fluctuations. Day traders may focus on short-term moves, but ignoring larger trends often leads to losses in countertrend trades.

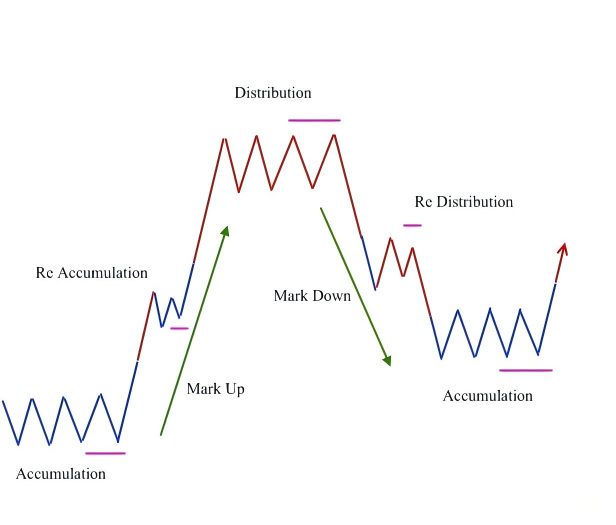

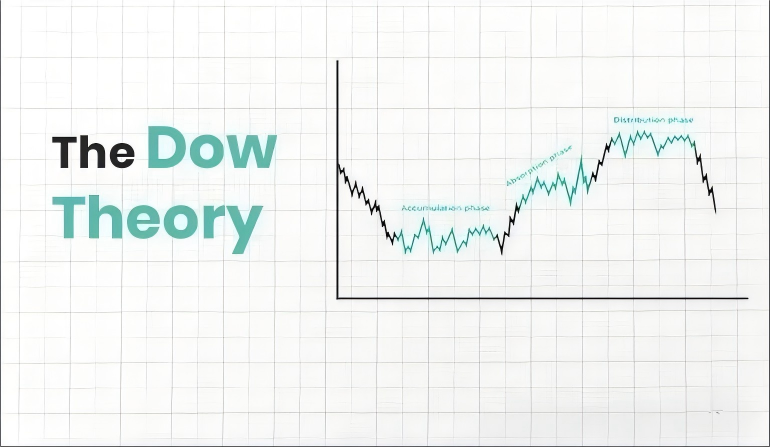

Trends Have Three Phases

From accumulation to public participation and finally distribution, this cycle is evident in markets ranging from cryptocurrencies to gold and stock indices. Identifying the current phase is crucial for determining position size and holding duration.

Intermarket Synchronization

Originally referring to the coordination between industrial and transportation indices, this principle now extends to analyzing correlations across sectors, indices, and asset classes.

Volume Confirms Trends

Volume acts as a “magnifier” for trends. If price movements lack volume support, the sustainability of the trend becomes questionable.

The Principle of Trend Continuation

Once a trend is established, it tends to persist until a sufficiently strong counterforce emerges. This principle aligns closely with modern trend-following strategies.

Dow Theory’s Buy and Sell Signals

Following Dow’s work, numerous studies and tests have been conducted to evaluate its effectiveness. In 1934, Alfred Cowles was among the first to test Dow Theory, concluding that its returns were relatively modest. However, this conclusion was later challenged. A separate analysis revealed that Dow Theory’s signals could yield an annualized return of 11.4%, outperforming a buy-and-hold portfolio’s 10.6% return.

While Dow Theory primarily focuses on long-term trading strategies, its principles are adaptable and can serve as a valuable tool for intraday traders.

Insights for Modern Intraday Traders

Whether you’re trading intraday, swing, or long-term, Dow Theory offers timeless lessons:

◎ Trend Comes First: Identifying the prevailing trend is the foundation of all trading decisions.

◎ The Importance of Closing Prices: Compared to opening prices or intraday highs and lows, closing prices tend to better reflect the market’s true sentiment.

◎ Volume-Price Relationship: Price movements supported by volume carry stronger conviction.

◎ Multi-Market Comparisons: Confirm trends by analyzing related indices, sectors, or assets.

Why Dow Theory Will Never Be Outdated

While technology, asset classes, and trading tools continue to evolve, the driving force behind markets—human psychology—remains unchanged. Greed and fear, herd mentality, and doubt still dominate price movements. Dow Theory focuses on how these psychological forces are reflected in prices, which is why it has endured for over a century.

For modern traders, Dow Theory isn’t a rigid set of entry and exit rules; it’s a foundational lens for understanding market structure. Amid the complexity of indicators and strategies, it helps traders focus on the essentials: trends, phases, and the relationship between price and volume.

Dow Theory may be old, but its wisdom remains timeless. For investors and traders navigating today’s markets, it offers a framework to cut through noise and see the bigger picture.