We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Company Overview:

Build Station LLC operates as a prominent retailer of building materials and finishing products, serving the Middle East market with primary operations in Saudi Arabia and the United Arab Emirates. The company positions itself as "one of the region's leading names in building materials and finishing products, supplying designer tiles & surfaces, sanitaryware, lighting solutions, furniture and accessories." The firm operates through a subsidiary structure under MHG for Trading CJSC and maintains a flagship retail location exceeding 25,000 square feet.

Saudi Arabia Construction Market Dynamics

The Saudi Arabian construction sector presents compelling growth fundamentals. The construction market in Saudi Arabia has emerged as a leader in the Middle East and North Africa with an estimated size of USD 70.33 billion in 2024. This market leadership position reflects the Kingdom's aggressive infrastructure development strategy under Vision 2030.

Government commitment to sector development is evidenced by substantial capital allocation. The Saudi Ministry of Municipal and Rural Affairs has initiated a five-year, $43 billion plan for constructing housing across the Kingdom. The program involves the construction of 240,000 units. This represents one of the most ambitious housing development programs globally, providing sustained demand visibility for building materials suppliers.

Building Materials Market Segment

The advanced building materials subsector demonstrates robust growth trajectories. The Saudi Arabian advanced building materials market generated revenue of USD 1,242.3 million in 2024, and is expected to witness a CAGR of 8.5% during the forecast period of 2024-2030. Additionally, the Hardware & Building Materials market in Saudi Arabia is projected to grow by 2.83% (2024-2029), resulting in a market volume of US$10.66bn in 2029.

These growth metrics indicate a favorable operating environment for Build Station's core business segments, particularly given the company's focus on premium finishing products and design-oriented solutions.

Business Model & Operations

Build Station operates a differentiated retail model focused on premium building materials and design solutions. The company's value proposition centers on comprehensive product offerings spanning:

• Designer tiles and surface solutions

• Sanitaryware and bathroom fixtures

• Lighting systems and solutions

• Furniture and interior accessories

• Customization services through in-house workshop capabilities

Geographic Footprint

The company maintains operations across key Gulf Cooperation Council markets:

Saudi Arabia: Primary market focus with localized product offerings and Arabic-language digital presence United Arab Emirates: Operational presence in Dubai's Al Quoz Industrial Area with established customer base

Competitive Positioning

Build Station's competitive advantages include:

1. Scale & Infrastructure: Flagship showroom exceeding 25,000 square feet provides comprehensive product demonstration capabilities

2. Customization Capabilities: In-house workshop enables bespoke solutions and value-added services

3. Product Portfolio Breadth: Comprehensive offering spanning multiple building materials categories

4. Regional Expertise: Deep understanding of local market preferences and regulatory requirements

Key Performance Indicators (KPIs) & Metrics to Monitor

For a company of this nature, investors would typically focus on the following KPIs (though this data is not public):

• Gross Merchandise Volume (GMV): The total value of transactions processed through the platform.

• Take Rate: The percentage of GMV captured as revenue.

• Number of Active Suppliers/Buyers: Growth in the ecosystem participants.

• Average Order Value (AOV)

• Customer Acquisition Cost (CAC) & Lifetime Value (LTV): Measures marketing efficiency and customer profitability.

Valuation:

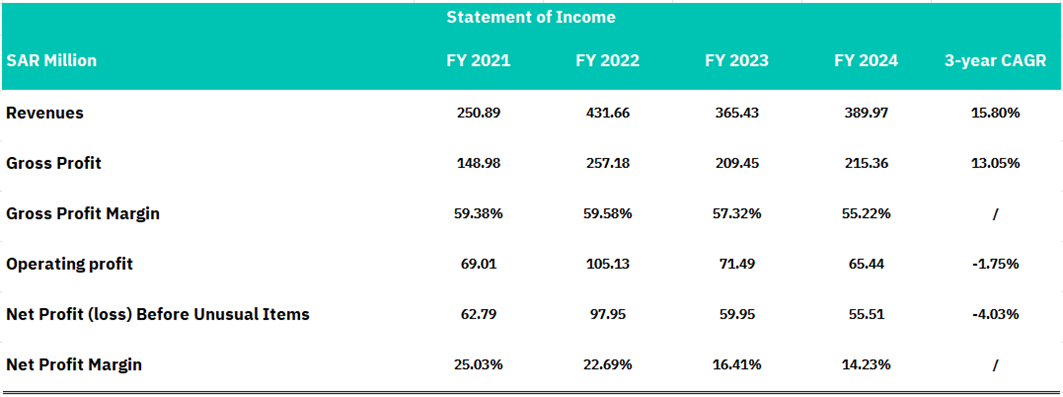

Income statement analysis

Based on Build Station's income statement, the company has delivered impressive revenue growth with a robust 15.80% CAGR over the three years, expanding from SAR 250.89 million in FY2021 to SAR 389.97 million in FY2024. However, this growth pattern exhibits notable volatility, peaking at SAR 431.66 million in FY2022 before experiencing a contraction in FY2023 and a partial recovery in FY2024, which may reflect cyclical demand patterns. Gross profit has grown at a healthy 13.05% CAGR, though gross margins have shown a concerning downward trend from 59.38% in FY2021 to 55.22% in FY2024, suggesting either intensifying competitive pressures, rising material costs, or potential pricing challenges in Build Station's market segments.

The company's operational efficiency presents significant red flags that warrant investor scrutiny. Despite strong revenue growth, operating profit has declined at a -1.75% CAGR, falling from SAR 69.01 million to SAR 65.44 million, indicating that operational expenses are growing faster than revenues and suggesting poor cost discipline or increased investment in infrastructure that has yet to generate returns. More alarmingly, net profit margins have deteriorated substantially from 25.03% to 14.23%, with net profit before unusual items declining at a -4.03% CAGR. This dramatic margin compression in Build Station's operations suggests the company is struggling with operational leverage and cost management, potentially due to project execution inefficiencies, increased administrative overhead, or higher financing costs.

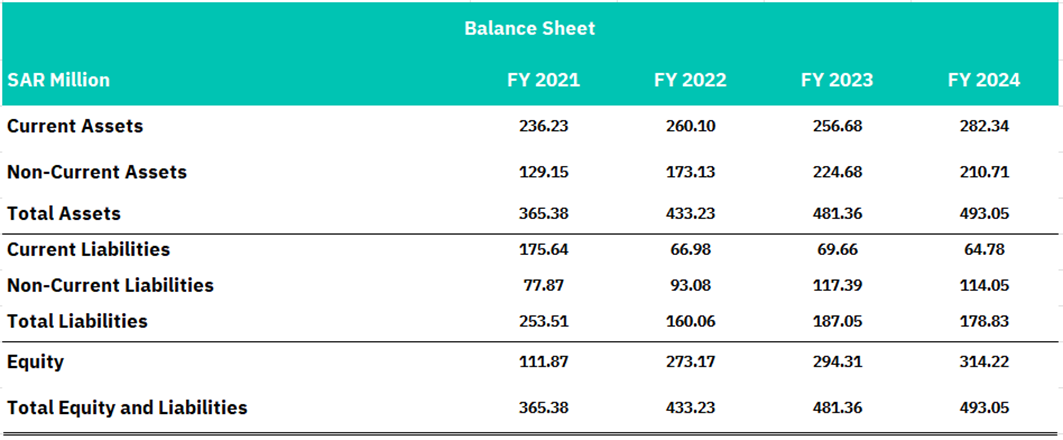

Balance sheet analysis

Build Station's balance sheet demonstrates solid asset growth and improving capital structure over the four years. Total assets expanded from SAR 365.38 million in FY2021 to SAR 493.05 million in FY2024, representing a healthy 10.4% CAGR that reflects the company's business expansion and investment in operational capabilities. The asset composition shows a strategic shift toward long-term investments, with non-current assets growing significantly from SAR 129.15 million to SAR 210.71 million, indicating substantial capital expenditure in property, plant, and equipment to support future growth. Current assets have remained relatively stable around SAR 250-280 million, suggesting consistent working capital management, though the modest growth may indicate potential liquidity constraints or more efficient inventory and receivables management.

The company's financial structure has undergone a remarkable transformation, showcasing dramatic improvements in leverage and equity positioning. Most notably, current liabilities decreased substantially from SAR 175.64 million in FY2021 to SAR 64.78 million in FY2024, indicating significant improvement in short-term debt management and operational cash flow generation. Total equity nearly tripled from SAR 111.87 million to SAR 314.22 million, representing an impressive 40.8% CAGR, while total liabilities declined from SAR 253.51 million to SAR 178.83 million. This deleveraging trend has strengthened Build Station's debt-to-equity ratio considerably, moving from a highly leveraged position of 2.3x in FY2021 to a more conservative 0.6x in FY2024. This balance sheet optimization demonstrates strong cash generation, retained earnings accumulation, and prudent financial management that positions the company well for future growth while reducing financial risk.

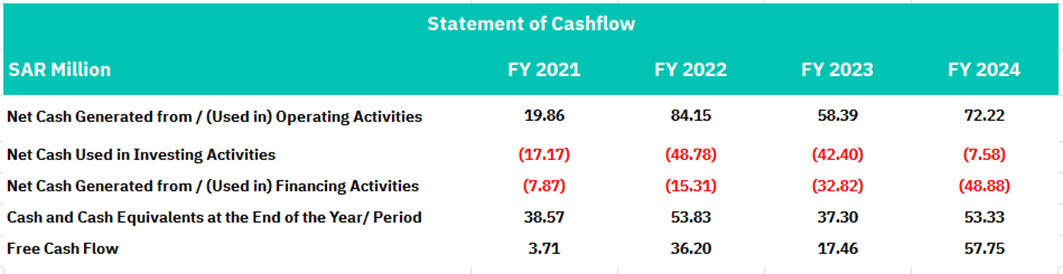

Cashflow analysis

Build Station's cash flow statement reveals strong operational cash generation capabilities with notable volatility across the review period. Operating cash flows demonstrate the company's ability to convert earnings into cash, generating SAR 19.86 million in FY2021, surging to SAR 84.15 million in FY2022, before moderating to SAR 58.39 million in FY2023 and recovering to SAR 72.22 million in FY2024. This volatility likely reflects the project-based nature of Build Station where cash collections are tied to project milestones and completion schedules. The company has maintained consistent investment in growth, with capital expenditures ranging from SAR 7.58 million to SAR 48.78 million annually, indicating an ongoing commitment to expanding operational capacity and maintaining competitive positioning in the construction sector.

Build Station's free cash flow profile shows remarkable improvement and consistency, delivering positive free cash flow throughout the entire period with powerful performance in recent years. Free cash flow expanded from SAR 3.71 million in FY2021 to an impressive SAR 57.75 million in FY2024, representing exceptional cash conversion efficiency. The substantial improvement in FY2022 and sustained strong performance through FY2024 demonstrate management's ability to balance growth investments with cash generation. The financing activities show net cash outflows in most periods, indicating debt reduction and potential dividend payments or share repurchases, which aligns with the balance sheet deleveraging observed previously. This consistent generation of free cash flow provides Build Station with financial flexibility for strategic investments, debt reduction, and shareholder returns, while maintaining adequate liquidity buffers to meet operational needs.

Conclusion

Build Station LLC presents compelling exposure to Saudi Arabia's rapidly expanding construction sector, valued at USD 70.33 billion in 2024 and representing the largest market in the MENA region. The company operates as a differentiated premium building materials retailer specializing in designer tiles, sanitaryware, lighting solutions, and furniture across key GCC markets. Build Station is well-positioned to capitalize on unprecedented government infrastructure spending through Vision 2030, particularly the Ministry of Municipal and Rural Affairs' ambitious USD 43 billion housing program targeting 240,000 units over five years. The advanced building materials subsector demonstrates attractive fundamentals with USD 1.24 billion in 2024 revenue and a projected 8.5% CAGR through 2030. The company's competitive advantages include a flagship 25,000+ square foot showroom, in-house customization capabilities, comprehensive product portfolio breadth, and deep regional market expertise that create meaningful barriers to entry and customer switching costs.

Build Station has delivered solid revenue growth with a 15.80% CAGR from SAR 250.89 million in FY2021 to SAR 389.97 million in FY2024, though this trajectory exhibits concerning volatility with a peak of SAR 431.66 million in FY2022 followed by contraction and partial recovery. The most significant red flag is deteriorating operational efficiency despite favorable market conditions: gross margins compressed from 59.38% to 55.22%, operating profit declined at -1.75% CAGR from SAR 69.01 million to SAR 65.44 million, and net profit margins deteriorated dramatically from 25.03% to 14.23%. This disconnect between revenue growth and profit generation suggests either poor cost discipline or infrastructure investments that have yet to generate commensurate returns. However, the company demonstrates exceptional balance sheet transformation with total equity nearly tripling to SAR 314.22 million, debt-to-equity improving from 2.3x to 0.6x, and free cash flow expanding impressively from SAR 3.71 million to SAR 57.75 million, providing significant financial flexibility and reduced financial risk.

Build Station represents a qualified opportunity offering attractive exposure to Saudi Arabia's infrastructure development theme through a well-positioned but operationally challenged platform. While the macro fundamentals, market positioning, and balance sheet strength support long-term value creation potential, the deteriorating operational metrics and margin compression create execution risk that requires careful monitoring. The investment case would be strengthened by evidence of margin stabilization, improved cost discipline, and sustained operational leverage that validates management's ability to capitalize on favorable market dynamics while maintaining profitability. This opportunity is best suited for investors seeking diversified exposure to the high-growth Saudi construction market with tolerance for operational volatility and execution risk during the company's growth phase. Until management demonstrates restored operational efficiency, the investment warrants cautious position sizing despite the compelling market opportunity.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, guest.meed, psmarketresearch, and financial reports.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.