We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Company Overview:

Founded in 1994, Sport Clubs Company has established itself as Saudi Arabia's premier fitness and wellness operator. The company owns and operates 56+ fitness centers across 18 cities throughout the Kingdom, covering over 150,000 square meters of fitness facilities. SCC operates under two leading fitness brands and has built a reputation for innovation, quality, and customer service excellence in the Saudi fitness market.

Business Model & Operations

SCC's business model centers on owning and operating premium fitness facilities that cater to Saudi Arabia's growing health-conscious population. The company's strategy focuses on:

• Geographic Expansion: Systematic rollout across major Saudi cities

• Brand Portfolio: Multi-brand approach targeting different market segments

• Facility Excellence: State-of-the-art equipment and modern amenities

• Community Focus: Localized programming and community engagement

• Technology Integration: Digital fitness solutions and member management systems

Market Analysis & Industry Dynamics

Saudi Fitness Market Fundamentals

The Saudi Arabian fitness industry is experiencing unprecedented growth driven by multiple structural factors:

Market Drivers:

• Vision 2030 Alignment: Government emphasis on health, wellness, and quality of life

• Demographic Dividend: Large young population (65% under 35) with increasing health awareness

• Economic Diversification: A Growing non-oil economy supporting discretionary spending

• Cultural Shift: Increasing acceptance and participation in fitness activities

• Female Participation: Expanding women's participation in sports and fitness activities

Market Size & Growth: The Saudi fitness market is estimated to be valued at approximately SAR 2.5 billion with a projected CAGR of 8-12% through 2030. This growth trajectory is supported by:

• Rising per capita health and fitness spending

• Increasing gym membership penetration rates

• Expansion of fitness culture beyond major cities

• Corporate wellness program adoption

Competitive Landscape

SCC holds a dominant market position in the organized fitness sector with significant competitive advantages:

Competitive Strengths:

• First-mover advantage with 30-year market presence

• Largest network of premium fitness facilities

• Strong brand recognition and customer loyalty

• Proven operational expertise and scalability

• Strategic locations in high-traffic areas

Valuation:

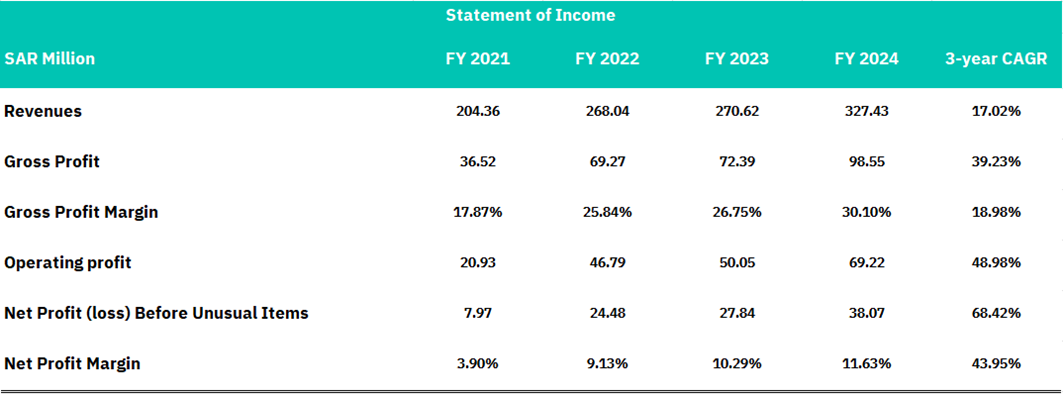

Income statement analysis

Based on the financial data analysis, Sport Clubs demonstrated exceptional revenue growth during FY 2021-2024, with total revenues increasing from SAR 204.36 million to SAR 327.43 million, representing a robust 17.02% compound annual growth rate. The company showed consistent momentum with particularly strong acceleration in FY 2024, indicating successful market positioning and effective expansion strategies in the competitive sports and leisure industry.

The company's profitability metrics reveal outstanding operational efficiency and margin expansion across all levels. Gross profit margin improved dramatically from 17.87% to 30.10%, while net profit margin surged from 3.90% to 11.63% over the three years. The operating profit CAGR of 48.98% and net profit CAGR of 68.42% significantly outpaced revenue growth, demonstrating the company's ability to achieve strong operating leverage through effective cost management and pricing optimization strategies.

From an investment standpoint, Sport Clubs presents a compelling opportunity with its consistent financial improvements and strong value creation potential. The combination of sustained top-line growth, expanding margins, and accelerating profitability trends suggests excellent management execution and competitive advantages. While investors should monitor the sustainability of such rapid margin expansion and high growth rates in future periods, the company's current financial trajectory positions it favorably within the sports club sector for continued shareholder value enhancement.

Balance sheet analysis

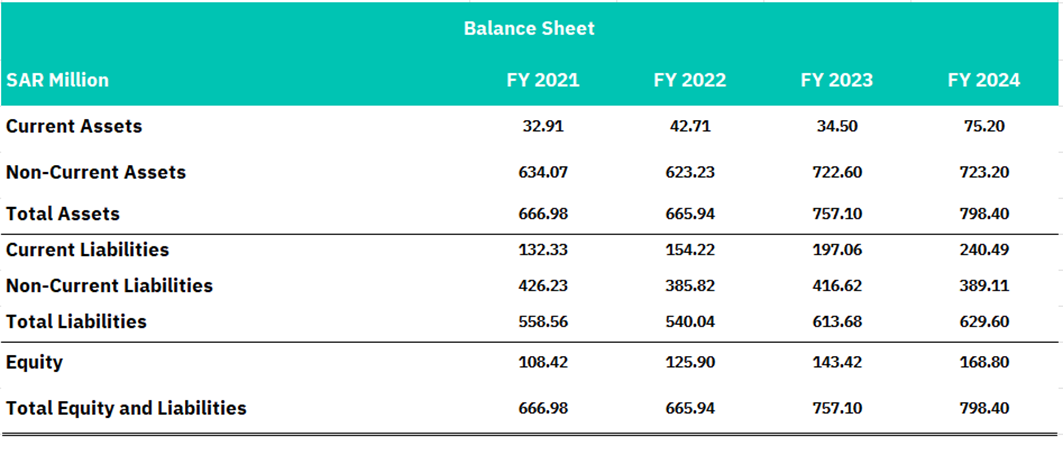

Sport Clubs demonstrates solid asset growth and strategic capital allocation. Total assets increased from SAR 666.98 million to SAR 798.40 million, representing a 19.7% cumulative growth over the three years. The asset base is predominantly comprised of non-current assets, which grew from SAR 634.07 million to SAR 723.20 million, indicating significant investments in long-term infrastructure, facilities, and equipment typical of the sports club industry. Current assets showed volatility but ended strongly at SAR 75.20 million in FY 2024, suggesting improved liquidity management.

The company's liability structure reveals a mixed financial profile with both opportunities and concerns. Total liabilities increased from SAR 558.56 million to SAR 629.60 million, with current liabilities rising significantly from SAR 132.33 million to SAR 240.49 million, representing an 82% increase over the period. This substantial growth in short-term obligations raises questions about working capital management and potential liquidity pressures. However, non-current liabilities remained relatively stable, fluctuating between SAR 385-426 million, suggesting disciplined long-term debt management and potential debt restructuring activities.

From a capital structure perspective, Sport Clubs demonstrates improving equity strength, with shareholders' equity increasing from SAR 108.42 million to SAR 168.80 million, a 56% rise that aligns well with the strong profitability trends observed in the income statement. The debt-to-equity ratio improved from 5.15x to 3.73x, indicating enhanced financial stability despite the absolute increase in liabilities. While the significant rise in current liabilities warrants monitoring for potential working capital challenges, the overall balance sheet reflects a company that is investing in growth while gradually strengthening its equity base, which supports the positive operational performance trends evident in the income statement analysis.

Cashflow analysis

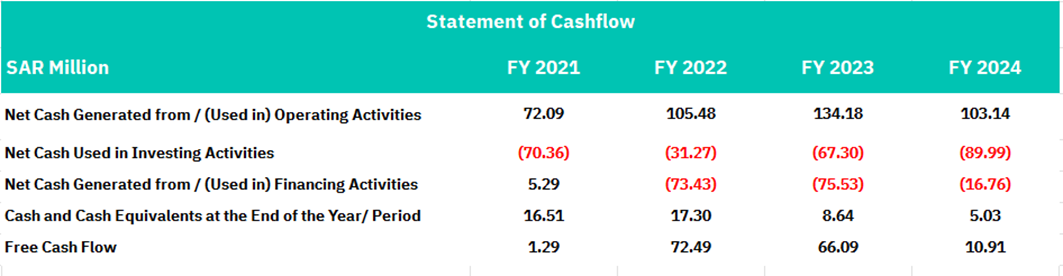

Sport Clubs' cash flow from operating activities demonstrates strong and consistent cash generation capabilities, with operating cash flows ranging between SAR 72-134 million annually over the FY 2021-2024 period. The company achieved a peak operating cash flow of SAR 134.48 million in FY 2023, though it moderated to SAR 103.14 million in FY 2024, still representing robust cash generation that significantly exceeds the net profit figures observed in the income statement. This strong operating cash flow profile indicates healthy working capital management and the company's ability to convert earnings into actual cash, providing a solid foundation for funding growth initiatives and debt service obligations.

The investing activities reveal a capital-intensive business model with consistent and substantial investments in long-term assets. Cash outflows for investing activities increased significantly from SAR 70.36 million in FY 2021 to SAR 89.99 million in FY 2024, reflecting the company's commitment to facility expansion, equipment upgrades, and infrastructure development typical of the sports club industry. The steady increase in capital expenditures aligns with the revenue growth trajectory and suggests management's confidence in future market opportunities, though investors should monitor the return on these investments given the substantial cash commitments required.

The financing activities show a strategic shift toward debt reduction and improved capital structure management. After generating SAR 5.29 million from financing activities in FY 2021, the company consistently used cash for financing activities in subsequent years, culminating in SAR 16.76 million of net cash outflows in FY 2024. This pattern suggests active debt paydown and potentially dividend distributions or share repurchases, contributing to the improved debt-to-equity ratio observed in the balance sheet. The free cash flow remained positive throughout the period, ranging from SAR 1.29 million to SAR 72.49 million, though the decline to SAR 10.91 million in FY 2024 warrants attention, given the increased capital intensity, and should be monitored for future cash flow sustainability.

Conclusion

Sport Clubs operates under a multi-brand strategy targeting different market segments and has built a strong reputation for innovation, quality, and customer service excellence. The Saudi fitness market presents exceptional growth opportunities, valued at approximately SAR 2.5 billion with a projected 8-12% CAGR through 2030, driven by Vision 2030 alignment, demographic advantages (65% population under 35), economic diversification, cultural shifts toward fitness acceptance, and expanding female participation in sports activities.

From a financial performance perspective, Sport Clubs demonstrated outstanding results during FY2021-2024, with revenues growing from SAR 204.36 million to SAR 327.43 million, representing a robust 17.02% compound annual growth rate. The company's profitability metrics revealed exceptional operational efficiency improvements, with gross profit margins expanding dramatically from 17.87% to 30.10% and net profit margins surging from 3.90% to 11.63%. The operating profit CAGR of 48.98% and net profit CAGR of 68.42% significantly outpaced revenue growth, demonstrating the company's ability to achieve strong operating leverage through effective cost management and pricing optimization strategies.

The company's balance sheet analysis shows solid asset growth with total assets increasing from SAR 666.98 million to SAR 798.40 million, predominantly comprised of non-current assets reflecting significant investments in long-term infrastructure and facilities. While shareholders' equity strengthened by 56% and the debt-to-equity ratio improved from 5.15x to 3.73x, the substantial 82% increase in current liabilities raises some concerns about working capital management. Cash flow analysis reveals strong operating cash generation capabilities ranging between SAR 72-134 million annually, though the capital-intensive nature of the business requires continuous substantial investments, and the decline in free cash flow to SAR 10.91 million in FY2024 warrants monitoring for future sustainability.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, Sport clubs official disclosures, and financial reports.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.