We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Company Overview:

Dar Al Majed Real Estate Co. (commonly known as Almajdiah) traces its origins to 1969 when it was founded by Sheikh Abdulrahman bin Nasser Al Majed, establishing deep-rooted expertise in Saudi Arabia's real estate sector spanning over five decades. The company has evolved from a local real estate developer into a comprehensive housing solutions provider, culminating in its successful public listing on the Saudi Exchange (Tadawul) in September 2025. Headquartered in Riyadh - Al Qirawan District - North of King Salman bin Abdulaziz Road, the company maintains a strategic focus on Saudi Arabia's capital city and surrounding areas, with potential for national expansion fueled by its recently raised capital.

Business Model & Operational Focus

Almajdiah has developed a differentiated business model centered on vertical integration, which encompasses in-house design, construction, and sales capabilities. This approach allows for:

• Enhanced cost control and margin optimization across the development lifecycle

• Faster project delivery timelines compared to outsourcing-dependent competitors

• Consistent quality assurance throughout project execution

• Greater flexibility in responding to market demand shifts and customer preferences

The company's primary focus remains on developing residential communities that feature integrated amenities, including parks, sports clubs, nurseries, retail outlets, and community centers. This community-centric approach has proven successful in creating sustainable living environments that maintain long-term property values and resident satisfaction.

IPO Performance & Capital Raising

Almajdiah's September 2025 initial public offering represents a landmark transaction in Saudi Arabia's real estate sector, demonstrating exceptionally strong investor appetite for quality housing developers aligned with Vision 2030 objectives. Key financial details of the offering include:

Total IPO Size: $336 million (SAR 1.26 billion)

Shares Sold: 90 million shares (representing 30% of company equity)

Valuation Implied: $1.12 billion (SAR 4.2 billion) enterprise value

Share Price: SAR 14.00 (priced at top of marketed range)

The offering witnessed overwhelming demand, particularly from institutional investors, with the institutional tranche oversubscribed by 107 times. This exceptional demand underscores institutional confidence in Almajdiah's business model and growth prospects within Saudi Arabia's expanding housing market.

Historical Performance Metrics

Almajdiah's operational achievements provide proxy indicators of the company's growth trajectory and execution capabilities:

• 2.5 million square meters of land developed

• 18,000+ housing units developed across projects

• 70,000+ residents housed in Almajdiah communities

• 1,300+ buildings constructed

These metrics demonstrate the company's substantial scale and proven track record in residential development, providing a foundation for future growth and potential market share expansion as Saudi Arabia addresses its housing requirements.

Market Position & Competitive Landscape

Saudi Real Estate Market Dynamics

Saudi Arabia's real estate sector is undergoing an unprecedented transformation driven by the kingdom's Vision 2030 initiative, which aims to diversify the economy and enhance the quality of life for its citizens. Several powerful structural trends support sustained growth in the residential segment:

• Population Growth: Riyadh's population expansion creates sustained housing demand

• Homeownership Goals: Vision 2030 targets increased Saudi citizen homeownership rates

• Foreign Investment: New laws allowing foreign property ownership beginning in 2026

• Economic Diversification: Non-oil sector growth supporting disposable incomes

• Mortgage Development: Expanding financing options for Saudi homebuyers

The mid-to-upper-middle income segment that Almajdiah specifically targets represents a particularly attractive niche, balancing affordability considerations with aspirational housing quality that aligns with rising Saudi household expectations.

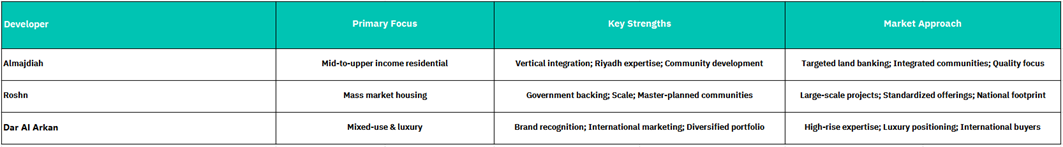

Competitive Positioning

Almajdiah competes in a fragmented but consolidating market alongside both government-backed developers and private sector players. Several distinct advantages characterize the company's competitive position:

Almajdiah's strategic focus on Riyadh provides a competitive edge through deep local market knowledge and established municipal relationships, though this geographical concentration also represents a potential vulnerability to regional economic shifts.

Strategic Partnerships & Industry Positioning

The company has demonstrated strategic foresight in forming partnerships that enhance its capabilities and market reach:

• National Housing Company: Collaboration on the "Mashriqiyah 1" project, achieving significant sales success

• Foster + Partners: Internal workshop cooperation with a renowned architecture firm in London

• Industry Events: Diamond sponsorship of real estate exhibitions to maintain brand visibility

These partnerships complement Almajdiah's core competencies and provide access to international best practices while maintaining the company's entrepreneurial agility and development speed advantages over larger, more bureaucratic competitors.

Market Expansion & Segment Development

Almajdiah's growth trajectory incorporates both geographical and product segment development opportunities:

Riyadh Focus: Continued concentration on high-growth corridors within Riyadh, including North Riyadh (Daruaza project) and the King Salman neighborhood (Almajdiah 125 project)

Geographical Diversification: Potential expansion beyond Riyadh, utilizing the war chest from the IPO proceeds

Product Innovation: Development of distinctive townhouse concepts and integrated community formats that differentiate from competitor offerings

Land Bank Expansion: Strategic acquisition of land plots, including the recent acquisition of 17,840 square meters valued at SAR 190 million

Technology Integration & Sustainability Alignment

Almajdiah has increasingly emphasized technology integration and sustainable development practices across its operations:

Smart Home Solutions: Incorporation of modern technologies and architectural concepts

Green Building Practices: Commitment to sustainability and environmentally responsible urban development

Construction Innovation: Leveraging cutting-edge building techniques to enhance efficiency and quality

These initiatives align with both consumer preferences and broader national objectives, potentially providing regulatory advantages and brand enhancement in an increasingly competitive market environment.

Valuation:

Income statement analysis

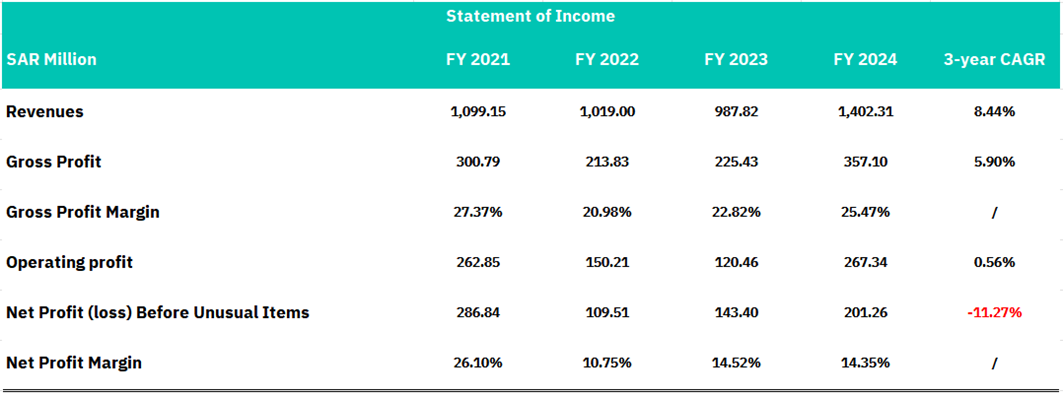

Almajdiah has demonstrated resilient top-line growth with revenues reaching SAR 1,402.31 million in FY 2024, representing a robust 3-year CAGR of 8.44% despite a notable dip in FY 2023. The company's gross profit expanded to SAR 357.10 million in FY 2024, achieving a 3-year CAGR of 5.90%, though gross margin volatility remains a concern, fluctuating from a high of 27.37% in FY 2021 to a low of 20.98% in FY 2022 before stabilizing at 25.47% in FY 2024. This margin compression suggests potential pricing pressures or rising cost of goods sold during the period, though the recovery in FY 2024 indicates improving operational efficiency. Operating profit similarly recovered to SAR 267.34 million in FY 2024, nearly matching FY 2021 levels with a modest 3-year CAGR of 0.56%, demonstrating the company's ability to control operating expenses even as it navigated a challenging mid-period.

The most significant red flag emerges at the net profit level, where earnings before unusual items declined at a -11.27% CAGR over the three years, falling from SAR 286.84 million in FY 2021 to SAR 201.26 million in FY 2024. The net profit margin has compressed substantially from 26.10% to 14.35%, indicating mounting below-the-line costs such as interest expense, taxes, or other financial charges that are eroding profitability despite improved gross margins.

Balance sheet analysis

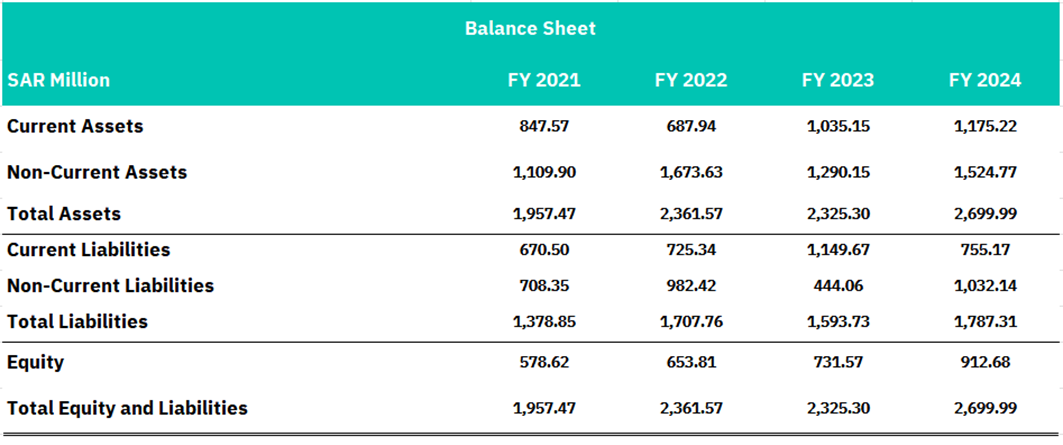

Almajdiah's balance sheet reflects a company in expansion mode, with total assets growing 37.9% from SAR 1,957.47 million in FY 2021 to SAR 2,699.99 million in FY 2024, representing a healthy 3-year CAGR of approximately 11.3%. The asset composition reveals a capital-intensive business model, with non-current assets comprising 56.5% of total assets in FY 2024 (SAR 1,524.77 million), suggesting significant investments in property, plant, equipment, or other long-term assets typical of logistics and industrial services firms. Current assets have grown more aggressively, increasing 38.7% to SAR 1,175.22 million in FY 2024, which may indicate expanding working capital needs to support revenue growth, though the spike to SAR 1,035.15 million in FY 2023, followed by further growth, raises questions about working capital efficiency and potential inventory or receivables accumulation that should be monitored for liquidity quality.

The liability side of the balance sheet reveals an increasingly leveraged capital structure that warrants investor caution. Total liabilities expanded 29.6% from SAR 1,378.85 million to SAR 1,787.31 million over the period, with a particularly concerning trend in non-current liabilities, which surged 46.0% to SAR 1,032.14 million in FY 2024 after dipping to SAR 444.06 million in FY 2023. This suggests either substantial new long-term debt issuance or lease obligations to finance the company's asset expansion. While equity has grown 57.7% to SAR 912.68 million, the debt-to-equity ratio has deteriorated from 2.38x in FY 2021 to 1.96x in FY 2024, and combined with the declining net profit margins observed in the income statement, this leverage profile presents heightened financial risk. The company's ability to service this debt load while maintaining profitability will be critical, as the mismatch between aggressive asset growth (11.3% CAGR) and declining net profits (-11.27% CAGR) suggests return on invested capital may be under pressure, potentially indicating suboptimal capital allocation or a transition period requiring time for new investments to mature.

Cashflow analysis

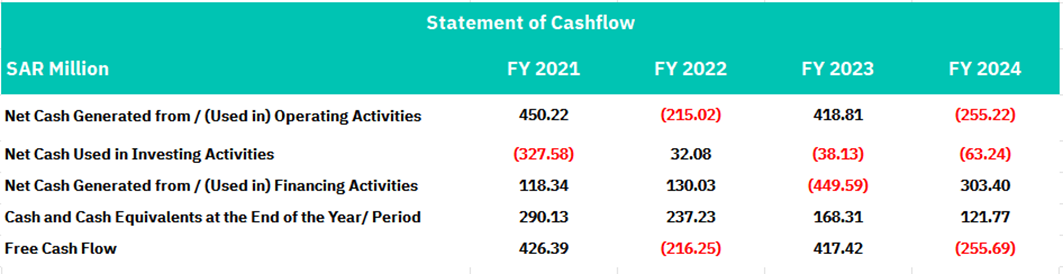

Almajdiah's cash flow statement reveals significant operational stress and deteriorating cash generation capability. Operating cash flow has been highly volatile, swinging from a robust SAR 450.22 million in FY 2021 to a concerning outflow of SAR (255.22) million in FY 2024, with negative cash generation also occurring in FY 2022 at SAR (215.02) million. This erratic pattern, despite relatively stable operating profits, points to severe working capital management challenges—likely driven by rising receivables, inventory buildup, or unfavorable payment terms that are tying up cash. The disconnect between the reported operating profit of SAR 267.34 million and the negative operating cash flow of SAR (255.22) million in FY 2024 is particularly alarming, suggesting either aggressive revenue recognition practices, deteriorating customer credit quality, or operational inefficiencies that are preventing the conversion of accounting profits into actual cash. This raises red flags about earnings quality and the sustainability of reported profitability.

The investing and financing activities reveal a company heavily reliant on external capital to fund operations and growth. While investing cash flows have been moderate and inconsistent—ranging from an inflow of SAR 32.08 million in FY 2022 to outflows in other years—the financing activities tell a more concerning story. Almajdiah has been forced to raise substantial external financing, with SAR 303.40 million generated in FY 2024 and SAR 130.03 million in FY 2022, essentially using debt or equity issuance to compensate for poor operating cash generation. Most critically, free cash flow has turned deeply negative at SAR (255.69) million in FY 2024, down from a healthy SAR 426.39 million in FY 2021, indicating the company is burning cash and cannot self-fund its operations or growth. Cash balances have declined precipitously from SAR 290.13 million to just SAR 121.77 million, leaving a minimal liquidity cushion. This cash flow profile, combined with rising leverage noted in the balance sheet, creates a precarious financial position where the company is increasingly dependent on external financing to bridge operational shortfalls—a situation that is unsustainable without significant operational improvements or a fundamental business turnaround.

Conclusion

Almajdiah represents a concerning paradox in Saudi Arabia's real estate sector—a company with impressive operational scale and strategic market positioning that is simultaneously experiencing severe financial deterioration. Its strategic focus on Riyadh's mid-to-upper-middle-income segment aligns perfectly with Vision 2030's homeownership objectives, and partnerships with entities like the National Housing Company and Foster+Partners demonstrate sophisticated market execution. However, these positives mask deeply troubling financial fundamentals that demand immediate investor scrutiny.

The financial statements reveal a company in distress despite modest revenue growth (8.44% 3-year CAGR to SAR 1,402.31 million). Net profit has collapsed at -11.27% CAGR, with margins compressing from 26.10% to 14.35%, indicating severe below-the-line cost pressures—likely interest expenses from aggressive leverage—that are overwhelming operational performance. Most alarmingly, operating cash flow has deteriorated from +SAR 450.22 million (FY 2021) to -SAR 255.22 million (FY 2024), raising serious questions about earnings quality and revenue recognition practices. Free cash flow is deeply negative at SAR 255.69 million, forcing the company to raise SAR 303.40 million in external financing in FY 2024 just to bridge operational shortfalls. Cash balances have plummeted to SAR 121.77 million while total liabilities expanded to SAR 1,787.31 million (debt-to-equity at 1.96x), creating a precarious liquidity position.

Despite strong market positioning and IPO momentum, Almajdiah presents unacceptable financial risk. The combination of negative cash generation, deteriorating profitability, rising leverage, and the fundamental inability to convert accounting profits into cash suggests either aggressive accounting practices, severe working capital mismanagement, or structural business model flaws. The company's financial trajectory is unsustainable—it cannot continue financing operations through external capital raises indefinitely. While the Saudi housing market offers genuine long-term growth opportunities, Almajdiah's execution has resulted in value destruction rather than creation, with return on invested capital clearly under pressure (11.3% asset growth versus -11.27% profit decline). Until management demonstrates operational turnaround with positive cash generation and improved working capital efficiency, investors should avoid this stock regardless of sectoral tailwinds. The IPO timing appears opportunistic, capitalizing on Vision 2030 enthusiasm while offloading risk to public market investors before fundamental weaknesses become more widely recognized.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, superagi, decypha, and financial reports.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.