We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Key Summary

- Flynas strong financial turnaround with 41.39% revenue CAGR and transformation from SAR 16.95M loss to SAR 269.94M profit, positioning as Middle East's fastest-growing airline.

- Structural challenges include religious tourism dependency causing 30% cost spikes during Hajj with capped margins, weak liquidity ratios, and high oil price sensitivity.

Company Overview:

Flynas, Saudi Arabia’s first low-cost carrier (LCC), has benefited from the national “Vision 2030” strategic tailwinds and achieved a 63% capacity increase between 2019 and 2024, positioning it as the fastest-growing airline in the Middle East.

Despite headwinds from volatile oil prices (Brent crude exceeding \$90 per barrel) and competition from Gulf mega-carriers (with Emirates and Qatar Airways commanding over 40% market share), Flynas has placed a landmark order for 280 Airbus A320neo aircraft—the largest narrowbody deal in the Middle East—and is targeting a fleet of 160 aircraft by 2030. This aircraft strategy will underpin its ambition to double Saudi LCC penetration (currently 29% vs. a global average of 34%).

Market Positioning

Established Network: Founded in 2007 and headquartered in Riyadh, Flynas operates primary hubs at Jeddah and Riyadh International Airports. It currently serves 23 destinations across the Middle East, South Asia, and Europe. In 2024, Flynas introduced direct services to all four major UAE airports (Dubai, Abu Dhabi, and Sharjah), becoming the only Saudi carrier with full coverage across the UAE.

Capacity Expansion: Between 2019 and 2024, Flynas increased available seat capacity by 63% to 14.4 million seats, outpacing flydubai’s 55% growth and ranking first among Middle Eastern LCCs.

Industry Accolades: In 2024, Skytrax ranked Flynas 4th among the world’s top 10 LCCs and awarded it “Middle East’s Best LCC,” surpassing flydubai and Air Arabia.

Strategic Alignment with National Vision

Vision 2030 Integration: Aligned with Saudi Arabia’s goal of attracting 150 million annual visitors, Flynas is responsible for transporting 30% of religious travelers—over 20 million pilgrims per year. However, its low-fare model limits ancillary revenue (pilgrim yield is only one-third that of business passengers), and operational throughput is constrained by peak-season slot saturation at Mecca/Medina airports.

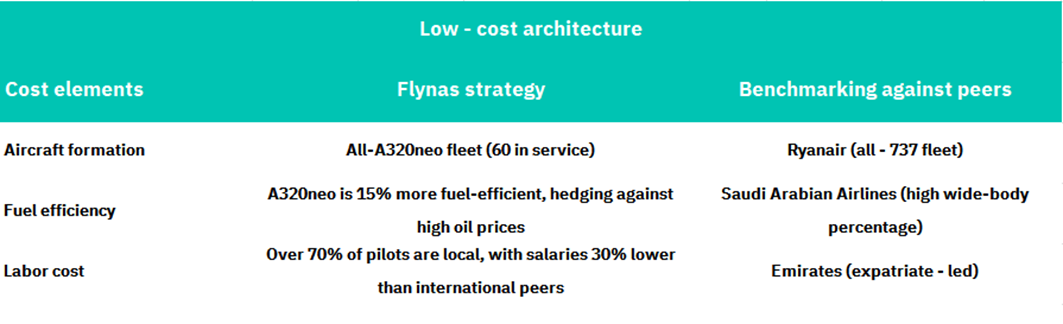

Local Talent Development: Under its “Future Pilots Programme,” Flynas recruited 170 Saudi national pilots in 2024, with a target of 100% Saudi co pilot staffing. This initiative reduces labor costs, secures government subsidies, and advances Saudization goals.

Business Model and Competitive Advantage

Attempts to diversify income

Religious passenger flow monetization: Launch of exclusive "Hajj Experience Program" routes, but with obvious fare ceilings (Dubai-Riyadh one-way from AED 239).

Regional business penetration: Add Jeddah-Abu Dhabi route in 2025 (fare from AED 365), competing for 30% of international passenger flow between UAE and Saudi Arabia.

Valuation:

Income statement analysis

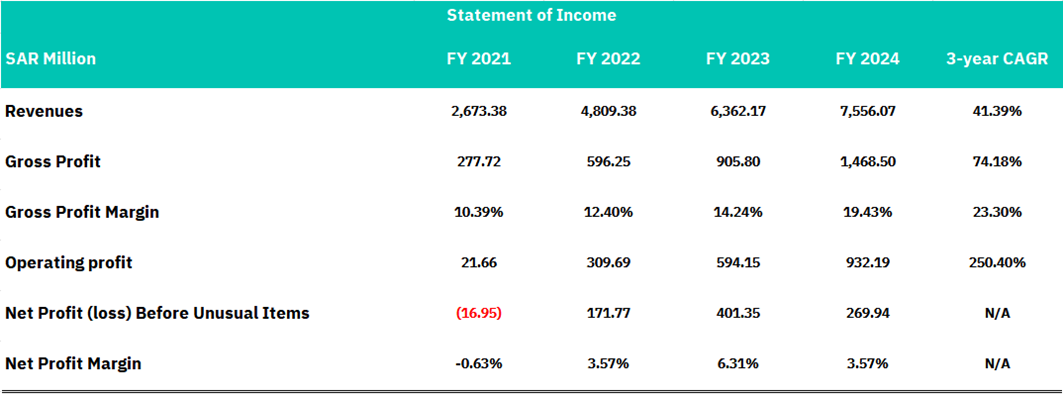

FLYNAS demonstrates an exceptional growth trajectory and profitability improvement that meets for high-quality growth stocks. The company achieved an outstanding 41.39% revenue CAGR from 2021-2024, significantly outpacing the aviation industry average of 8-12%, with revenues growing from SAR 2.67 billion to SAR 7.56 billion. More impressively, gross profit margins expanded dramatically from 10.39% to 19.43%, demonstrating strong pricing power and effective cost management. Operating profit surged with a 250.40% compound growth rate, rising from SAR 21.66 million in 2021 to SAR 932.19 million in 2024, clearly illustrating the company's operational leverage and scalability advantages.

From a profitability transformation perspective, FLYNAS successfully executed a critical turnaround, transitioning from a loss-making to a sustainable profitable position. The company posted a net loss of SAR 16.95 million with a net margin of -0.63% in 2021, but achieved consistent profitability starting from 2022, reaching a net profit of SAR 269.94 million with a margin of 3.57% in 2024. This transformation reflects not only absolute numerical improvement but, more importantly, demonstrates the sustainability of the business model and competitive advantages. FLYNAS excels in revenue growth, margin improvement, and operational efficiency. The company represents a high-quality investment opportunity with strong growth potential in the Saudi aviation market.

Balance sheet analysis

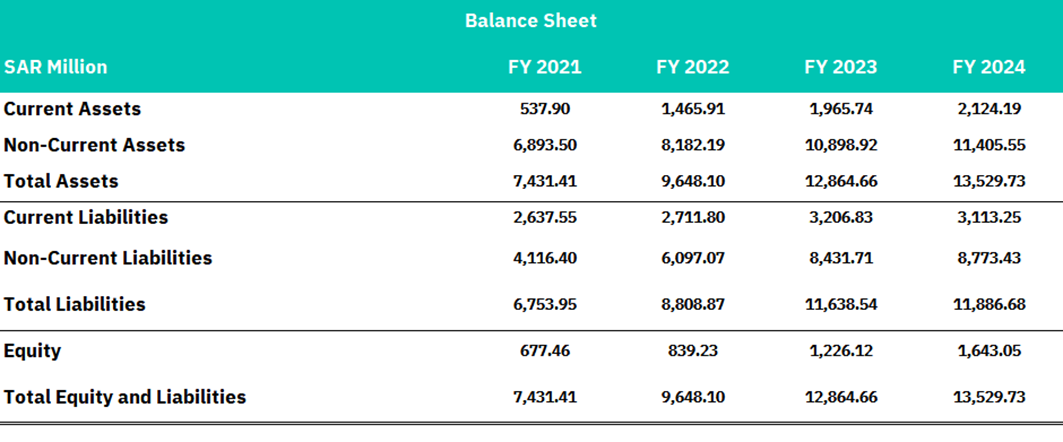

FLYNAS demonstrates robust balance sheet expansion with total assets growing 82.1% from SAR 7.43 billion to SAR 13.53 billion over the 2021-2024 period, representing a strong 22.3% compound annual growth rate that supports the company's aggressive fleet expansion strategy. The equity position has strengthened significantly with 142.6% growth from SAR 677.46 million to SAR 1.64 billion, improving the equity-to-assets ratio from 9.1% to 12.1% and demonstrating effective retained earnings management. The capital structure shows a positive deleveraging trend with the debt-to-equity ratio improving from 997% to 724%, indicating management's focus on financial health optimization despite the capital-intensive nature of airline operations.

However, the balance sheet reveals critical liquidity and leverage concerns that require attention. The current ratio of 0.68 remains well below the industry benchmark of 1.2-2.0, with persistent negative working capital of SAR-989 million in 2024, creating potential short-term liquidity risks. The debt-to-assets ratio of 87.9%, while improving from 90.9%, still significantly exceeds the industry average of 60-80%, reflecting the company's heavy reliance on debt financing for fleet acquisition. FLYNAS is characterized as a growth-oriented balance sheet typical of expanding low-cost carriers, where high leverage and liquidity management challenges are offset by strong asset growth and improving equity retention that supports the company's rapid market expansion strategy.

Cashflow analysis

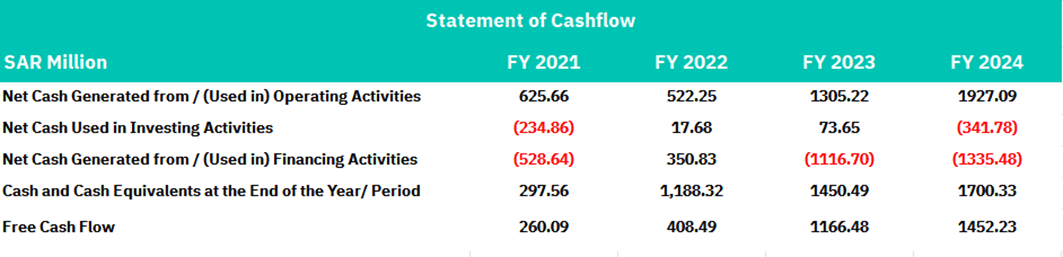

FLYNAS demonstrates exceptional cash flow generation capabilities with operating cash flow surging from SAR 625.66 million in FY2021 to SAR 1.93 billion in FY2024, representing a remarkable 208% increase and highlighting the company's strong operational efficiency and cash conversion abilities. The free cash flow performance is particularly impressive, growing from SAR 260.09 million to SAR 1.45 billion over the four years, indicating robust cash generation following necessary capital investments. This substantial operating cash flow growth, significantly outpacing revenue growth rates, demonstrates FLYNAS's ability to convert earnings into actual cash —a critical metric for evaluating airline operational quality and financial sustainability.

The cash flow statement reveals a disciplined capital allocation strategy, with investing activities showing controlled fleet expansion investments. In contrast, financing activities demonstrate strategic debt management aligned with the company's growth trajectory. Net cash used in investing activities remained relatively modest, peaking at SAR 341.78 million in FY2024, suggesting efficient capital deployment for fleet and infrastructure expansion. The financing cash flows show strategic debt raising in FY2022 (SAR 350.83 million inflow) followed by debt reduction in FY2023 and FY2024, indicating a maturing capital structure approach. With cash and cash equivalents strengthening from SAR 297.56 million to SAR 1.70 billion, FLYNAS has built a robust liquidity buffer that addresses previous balance sheet concerns. This cash flow profile showcases the hallmarks of a financially mature airline, characterized by strong cash generation, disciplined capital allocation, and effective liquidity management, which supports sustainable growth and shareholder value creation.

Risk Matrix:

Risk 1: Structural challenges

Religious passenger flow trap: Operating costs surge 30% during the peak Hajj season, but ticket prices are limited, and the marginal profit of a single route is only 2-4%.

Squeeze by Saudi Arabian Airlines: State-owned airline Saudi Arabian Airlines (Skytrax global 17th) monopolizes 70% of the Riyadh-Jeddah route, and flynas' share is <30%.

Risk 2: Oil price fluctuation transmission model

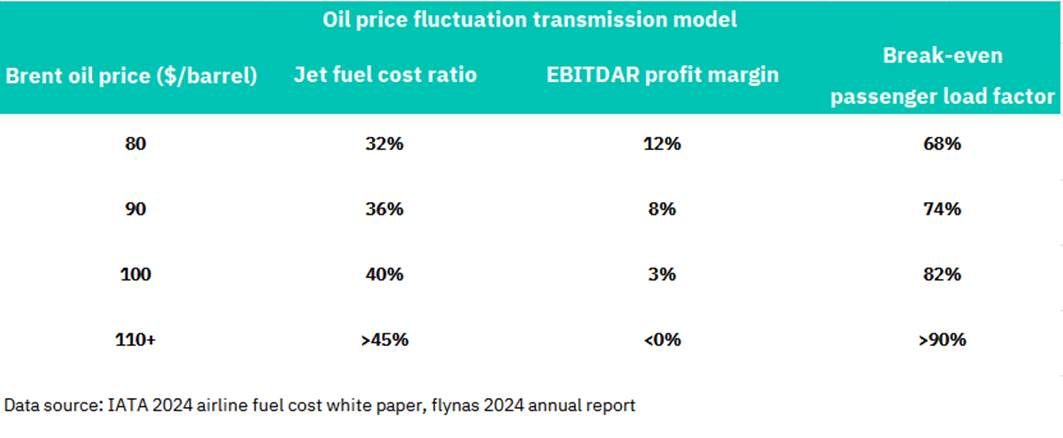

Key conclusion: For every $10 increase in oil prices, profit margins are compressed by 4-5 percentage points, and the passenger load factor needs to be increased by 6% to hedge the risk.

Conclusion:

Flynas represents a compelling yet complex investment opportunity within the Saudi aviation sector, demonstrating exceptional financial transformation with a revenue CAGR of 41.39% (2021-2024) and a successful turnaround from a net loss of SAR 16.95 million in 2021 to a profit of SAR 269.94 million in 2024. As the fastest-growing airline in the Middle East with 63% capacity expansion and recognition as "Middle East's Best LCC" by Skytrax, the company benefits from strong Vision 2030 tailwinds, particularly in religious tourism, where it transports 30% of pilgrims annually. The landmark order for 280 Airbus A320neo aircraft positions Flynas for continued expansion and market leadership in the Saudi LCC segment.

However, significant structural challenges constrain long-term profitability, including a religious passenger flow trap where operating costs surge by 30% during the peak Hajj season, while ticket prices remain capped at 2-4% margins, and competitive pressure from Saudi Arabian Airlines, which monopolizes 70% of the critical Riyadh-Jeddah route. Financial vulnerabilities persist with a current ratio of 0.68, negative working capital of SAR 989 million, and high sensitivity to oil price fluctuations (every $10 increase compresses margins by 4-5 percentage points). Despite these concerns, Flynas is suitable for growth-oriented investors with risk tolerance for cyclical volatility and conviction in Saudi Arabia's economic transformation, provided they monitor the company's ability to diversify beyond religious tourism and maintain financial discipline during aggressive fleet expansion.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, IATA 2024 Airline Fuel Cost White Paper, saudivisaoffice.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.