We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Company Overview:

Miahona (Tadawul: 2084), a core player in Saudi Arabia's water infrastructure sector, was officially listed on the Saudi Main Market (TASI) on June 6, 2024, becoming a significant new force in the utilities sector of the Saudi capital market. The company raised funds through its initial public offering. Vision Invest, as the main shareholder, sold 30% of the company's equity, totaling 48,277,663 common shares, injecting new capital momentum into the company's development.

Miahona uses the Public-Private Partnership model as its core business model, focusing on the development, financing, construction and long-term operation of water and wastewater treatment projects. The company's business model has the following characteristics:

Sustainable solutions: The company is committed to developing environmentally friendly water management solutions that align with Saudi Arabia's "Vision 2030" strategic requirements for sustainable water management.

Full life cycle services: From project planning to long-term operation and maintenance, it provides comprehensive services for water infrastructure to ensure the economic and reliable operation of the project throughout its life cycle.

Technology-driven operations: The company utilizes advanced technologies to achieve efficient water management, reduce operating costs, and enhance service quality.

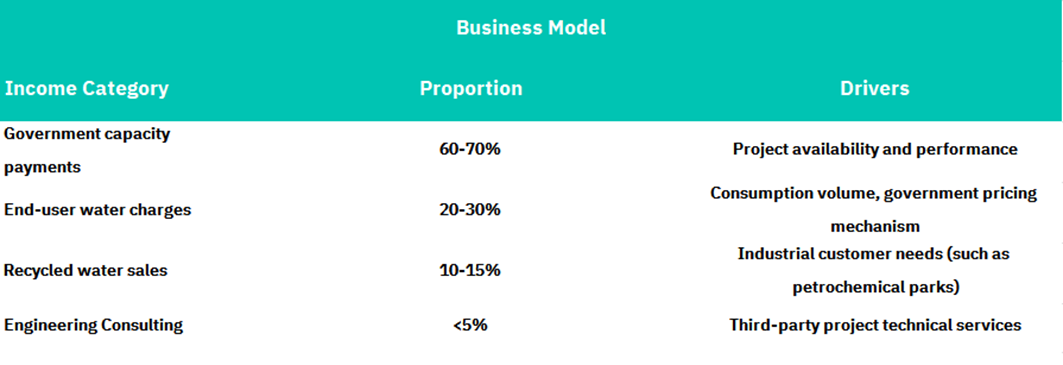

Business Model

Income pillar:

Government capacity payment (60-70%) - low-risk cash flow locked in a 25-year contract (supported by sovereign rating A1/A+), and smart pipe network technology builds a moat.

Growth engine:

Recycled water sales (10-15%) - Saudi Arabia's mandatory industrial recycled water policy (≥40% coverage in 2026) drives both volume and price increases, and the carbon rights trading will be implemented in 2026, releasing 67%+ of potential value.

Risk balancer:

Terminal water fee (20-30%) - the government pricing mechanism suppresses short-term elasticity (annual increase <4%), but is hedged through tiered pricing and cost transfer clauses.

Strategic leverage:

Engineering consulting (<5%) - light asset, high ROE business, serving as a technology testing ground and customer diversion entrance, 40% conversion rate empowers PPP project bidding.

Valuation:

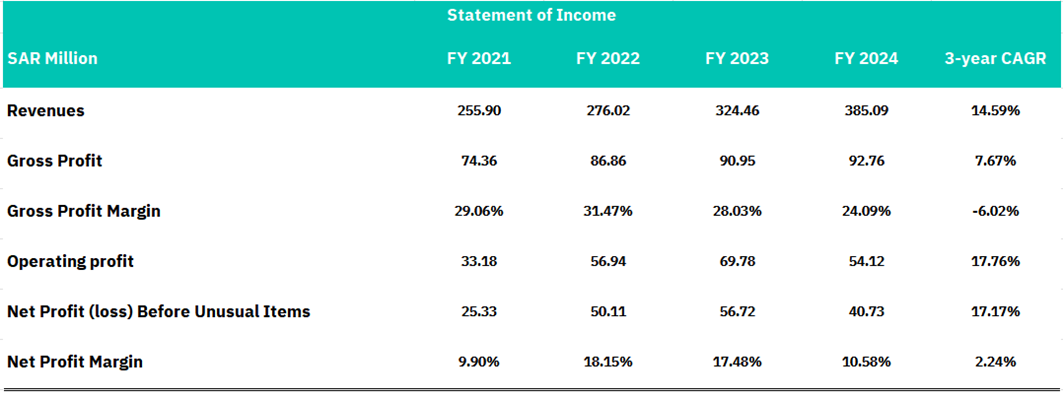

Income statement analysis

Miahona has demonstrated impressive revenue growth over the three years, with revenues increasing at a 14.59% CAGR to reach SAR 385.09 million in FY 2024, representing a 50.5% total increase from FY 2021. The company shows strong market expansion capabilities and accelerating growth momentum, with FY 2024 delivering the strongest annual revenue increase of 18.7%. This robust top-line performance indicates effective business development strategies and successful market penetration across the company's operating segments.

However, the company's profitability metrics reveal concerning trends that overshadow the positive revenue story. Gross profit margins have deteriorated significantly, from a peak of 31.47% in FY 2022 to 24.09% in FY 2024, representing a troubling 7.40% compression and a -6.02% 3-year CAGR in margin performance. Similarly, net profit margins have declined from 18.15% in FY2022 to 10.58% in FY2024, despite absolute profit growth. This disconnect between strong revenue growth (14.59% CAGR) and weaker gross profit growth (7.67% CAGR) suggests the company is facing significant cost pressures, and potential pricing power limitations are eroding profitability.

From an investment perspective, Miahona presents a mixed outlook that requires careful monitoring. While the strong revenue trajectory and maintained profitability across all periods demonstrate the company's growth capabilities and market position, the persistent margin compression raises questions about long-term sustainability and competitive dynamics. Investors should focus on management's strategic response to these profitability challenges, including cost structure optimization, pricing strategy adjustments, and operational efficiency improvements. The company's ability to stabilize and improve margins while maintaining growth momentum will be critical for future value creation and should be closely monitored in upcoming quarterly results.

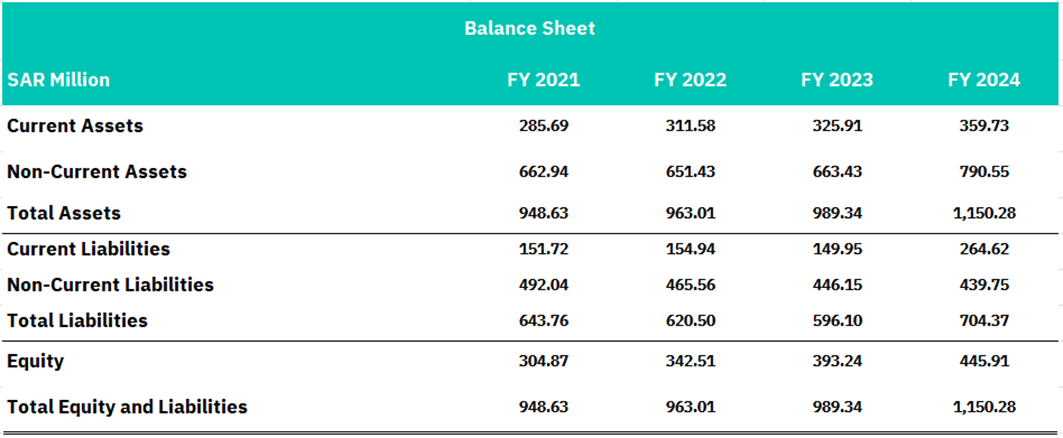

Balance sheet analysis

Miahona's balance sheet demonstrates solid asset growth and capital allocation efficiency over the three years, with total assets expanding from SAR 948.63 million to SAR 1,150.28 million, representing a 5.67% CAGR. The company has maintained a balanced asset structure, with non-current assets comprising approximately 69% of total assets in FY 2024, indicating significant long-term investments in infrastructure and growth capabilities. Current assets have grown steadily at a 7.86% CAGR to SAR 359.73 million, suggesting improved working capital management and liquidity positioning. This asset expansion, coupled with consistent growth across both current and non-current categories, reflects management's strategic focus on building operational capacity while maintaining adequate liquidity buffers.

The company's liability structure reveals a mixed picture with notable shifts in debt composition and working capital dynamics. Current liabilities experienced significant volatility, increasing sharply from SAR 149.95 million in FY 2023 to SAR 264.62 million in FY 2024, representing a 76% year-over-year increase that raises questions about short-term financial management. Conversely, non-current liabilities have decreased consistently from SAR 492.04 million in FY 2021 to SAR 439.75 million in FY 2024, suggesting effective long-term debt reduction or restructuring strategies. The current ratio deteriorated from 2.17x in FY2023 to 1.36x in FY2024, indicating potential liquidity pressure despite absolute growth in current assets. Total liabilities increased to SAR 704.37 million in FY 2024, with the debt-to-assets ratio rising to 61.2% from 60.2% in the previous year.

From a capital structure and financial strength perspective, Miahona has demonstrated resilience with equity growing at a robust 10.55% CAGR to reach SAR 445.91 million in FY 2024. The equity-to-assets ratio improved from 32.1% in FY 2021 to 38.8% in FY 2024, indicating strengthening financial leverage and reduced dependency on external financing. However, the significant increase in current liabilities in FY 2024 warrants close monitoring, as it could signal either aggressive expansion financing or potential working capital management challenges. The company's asset base expansion, combined with steady equity growth, suggests management is successfully reinvesting profits to drive future growth while maintaining a reasonable leverage profile.

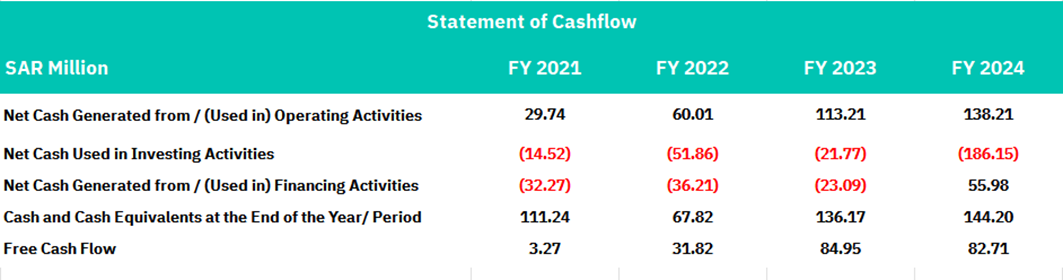

Cashflow analysis

Miahona demonstrates exceptional operational cash flow generation with operating cash flow surging from SAR 29.74 million in FY2021 to SAR 138.21 million in FY2024, representing a remarkable 365% increase and a 67% compound annual growth rate. This dramatic improvement reflects enhanced operational efficiency, strong revenue growth with improved working capital management, and successful execution of business strategy. Free cash flow performance is equally impressive, progressing from SAR 3.27 million to SAR 82.71 million over the period, representing a 2,430% increase that highlights management's exceptional ability to convert earnings into cash and provides substantial resources for shareholder returns and strategic investments.

The company's investment activities reveal a strategic evolution in capital allocation, with investment outflows dramatically scaling from an average of SAR 29.3 million annually during FY2021-2023 to SAR 186.15 million in FY2024—a 756% increase, suggesting major growth initiatives or acquisitions. Simultaneously, financing activities demonstrate prudent capital structure management, transitioning from net outflows averaging SAR 30.5 million in the earlier years to positive inflows of SAR 55.98 million in FY2024, likely indicating strategic refinancing or equity raising to fund expansion. Cash and cash equivalents maintained a healthy position, increasing from SAR 111.24 million to SAR 144.20 million, providing adequate liquidity and financial flexibility.

Miahona exhibits hallmarks of a high-quality growth company with exceptional cash generation capabilities and strong free cash flow conversion efficiency. The substantial increase in investment spending in FY2024 suggests management is positioning for the next growth phase, while the company's robust operational cash flow trajectory provides downside protection. Key areas to monitor include returns on the significant FY2024 investment outlay and sustainability of operating cash flow growth as the company reaches operational maturity. The investment intensity ratio of 135% of operating cash flow in FY2024 indicates an aggressive but well-funded growth posture that merits a premium valuation multiple.

Investment Risks

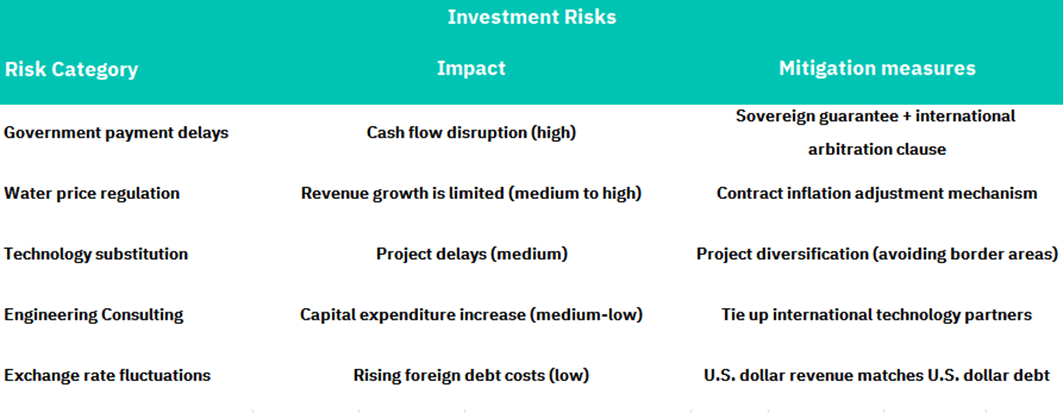

Miahona's risk profile reveals a sophisticated understanding of key operational and financial vulnerabilities, with the company demonstrating proactive risk management through well-structured mitigation strategies. The primary concern centers on government payment delays, which pose a high impact threat to cash flow stability—a critical vulnerability for any company dependent on public sector contracts. However, management has effectively addressed this risk through sovereign guarantees and international arbitration clauses, providing legal recourse and payment security that substantially reduces counterparty risk. Additionally, water price regulation presents a medium-to-high revenue growth constraint, but the company has intelligently incorporated contract inflation adjustment mechanisms to protect margins against regulatory pricing pressures, demonstrating forward-thinking commercial structuring.

The operational risk landscape shows moderate exposure to technology substitution and engineering consulting cost escalation, both carrying medium to medium-low impact ratings that suggest manageable business disruption potential. Miahona's mitigation approach, through project diversification away from border areas and strategic partnerships with international technology providers, reflects astute operational planning and effective geographic risk distribution. These strategies not only reduce concentration risk but also enhance technological capabilities and market positioning, potentially converting risk mitigation into competitive advantages. The company's focus on avoiding higher-risk border regions while maintaining project diversification indicates mature risk assessment capabilities and prudent capital allocation.

Risk Assessment: MODERATE with Strong Mitigation Framework - While Miahona faces legitimate exposure to government payment timing and regulatory pricing pressures, the comprehensive mitigation strategies significantly reduce investment risk to acceptable levels for institutional investors. The company's proactive approach to currency hedging through U.S. dollar revenue-debt matching eliminates foreign exchange risk, while sovereign guarantees provide downside protection against the most significant cash flow threat. Key monitoring areas include the execution of international arbitration provisions, if needed and the effectiveness of inflation adjustment mechanisms in preserving margin stability. The risk-adjusted return profile remains attractive, given the robust mitigation framework; however, investors should maintain awareness of regulatory developments in water pricing and government payment processing efficiency.

Conclusion

Miahona presents a compelling investment opportunity within Saudi Arabia's rapidly expanding water infrastructure sector, demonstrating exceptional operational cash flow generation with a 67% CAGR from FY2021 to FY2024 and free cash flow growth of 2,430% over the same period. The company's Public-Private Partnership business model provides stable, long-term revenue streams anchored by 25-year government contracts with sovereign guarantees, while diversified income sources, including recycled water sales and engineering consulting, create multiple growth vectors aligned with Saudi Vision 2030. However, persistent margin compression—with gross profit margins declining from 31.47% to 24.09% between FY2022-2024—signals cost pressures that require careful monitoring, despite strong top-line growth of 14.59% CAGR.

The company's financial profile reflects a maturing enterprise successfully transitioning from growth-stage capital deployment to sustainable cash generation, evidenced by the dramatic scaling of investment activities to SAR 186.15 million in FY2024 and improved equity positioning with a 10.55% CAGR in shareholder equity. Miahona's comprehensive risk management framework effectively addresses key vulnerabilities through sovereign guarantees, international arbitration clauses, and currency hedging strategies, reducing investment risk to acceptable institutional levels. The balance sheet demonstrates adequate liquidity and reasonable leverage, though the 76% increase in current liabilities in FY2024 warrants attention regarding working capital management.

Miahona merits a premium valuation multiple reflecting its superior cash conversion characteristics, defensive utility-like revenue base, and strategic positioning in Saudi Arabia's essential infrastructure modernization. The investment intensity ratio of 135% in FY2024 indicates management's confidence in deploying capital for value-creating growth initiatives, while the robust free cash flow profile provides downside protection and funding flexibility. Key catalysts include execution returns on recent capital investments, margin stabilization through operational efficiency gains, and potential upside from carbon rights trading implementation in 2026. Investors should monitor quarterly margin trends and government payment processing efficiency while capitalizing on the company's fundamental strength in a structurally growing sector.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, Ministry of Environment Water and Agriculture, Arabnews.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.