Please use a PC Browser to access Register-Tadawul

How to Deposit Funds via Apple Pay?

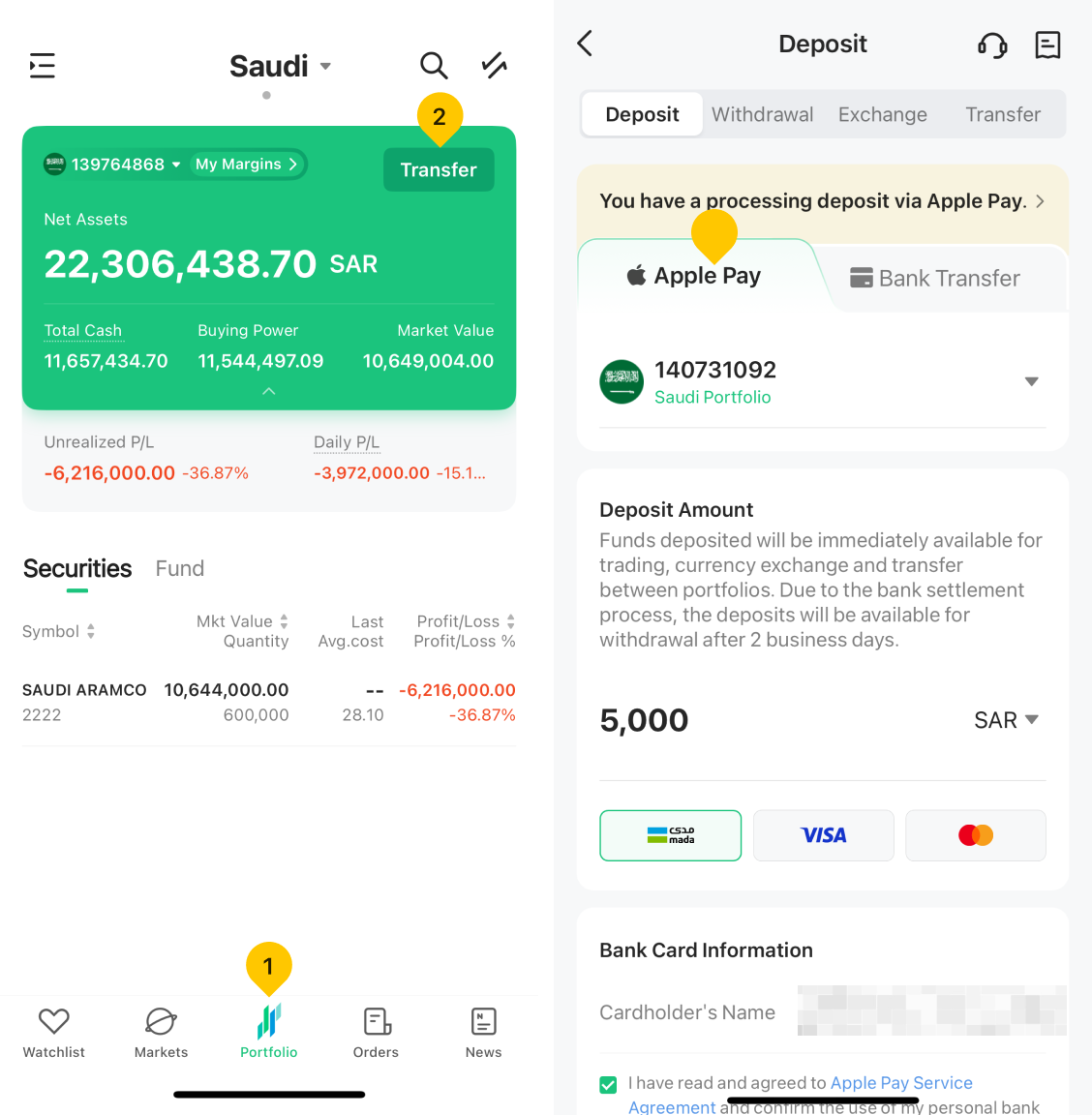

Step 1: Go to the Portfolio page and tap "Transfer" to initiate the deposit process.

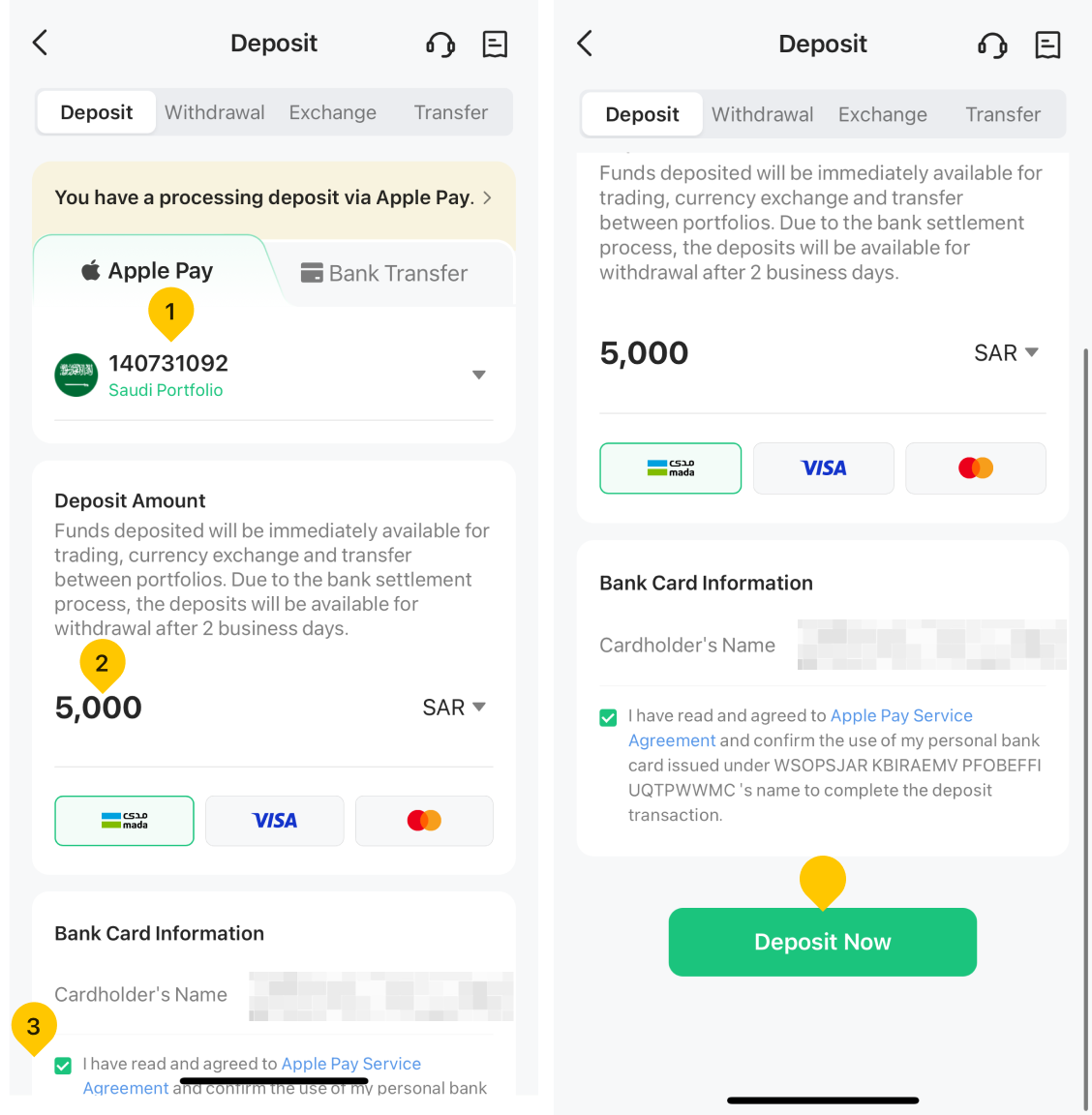

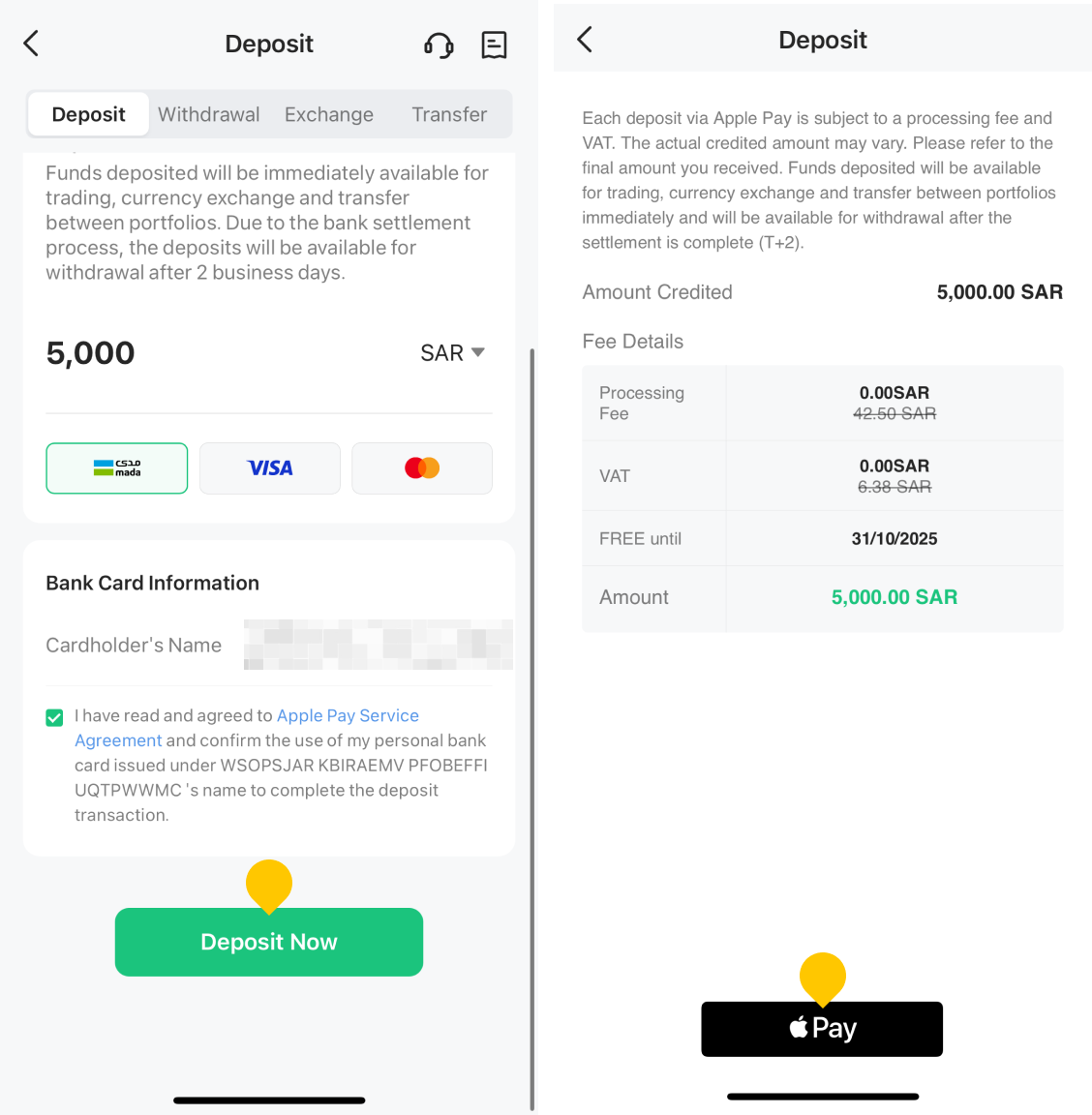

Step 2: Choose the portfolio you want to deposit into, enter the deposit amount (minimum 100 SAR), check the confirmation box, and tap "Deposit Now".

Step 3: Tap "Pay". Please ensure that your Apple Pay is linked to a Mada card and that your balance is sufficient; otherwise, the payment may fail.

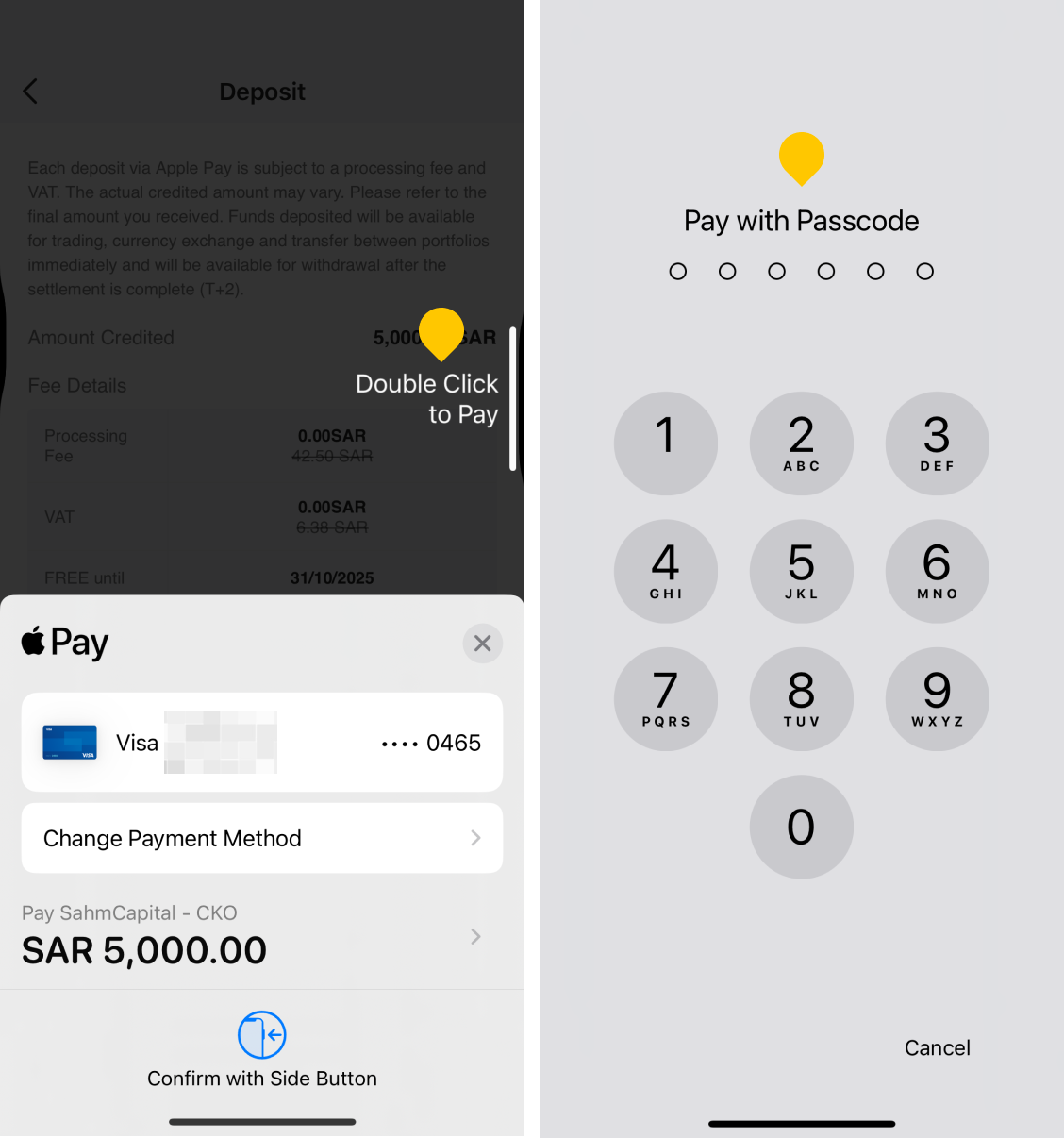

Step 4: Confirm your payment using the side button, then enter your Passcode.

Step 5: You have successfully deposited funds into Sahm via Apple Pay. Please note that funds deposited via Apple Pay will be immediately available for trading, currency exchange and transfer. Due to the bank settlement process, the deposits will be available for withdrawal after 2 business days.

Important Notes:

1. When users deposit funds via Apple Pay, the following charges will apply:

- Service Fee: 2.5% x deposit amount, The minimum charge for a single transaction is 3SAR, and the maximum charge is 10SAR.

- Tax: 15% of the service fee

2. The minimum deposit amount is 100 SAR, with a maximum limit of 50,000 SAR per transaction and a total monthly deposit limit of 100,000 SAR.

3. Apple Pay deposits are only supported via Mada cards; credit card deposits are not accepted at this time.

4. Please use your personal bank card for deposits (the cardholder's name must match the account holder's information); otherwise, the transaction may trigger a refund and incur related fees.

Client Due Diligence (CDD) for Apple Pay Deposits

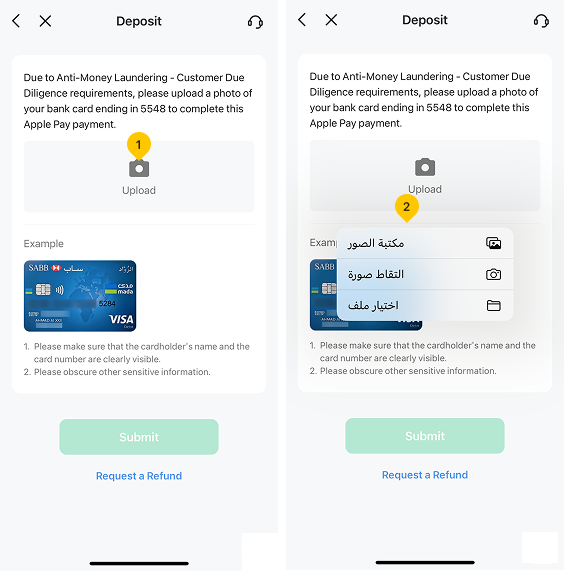

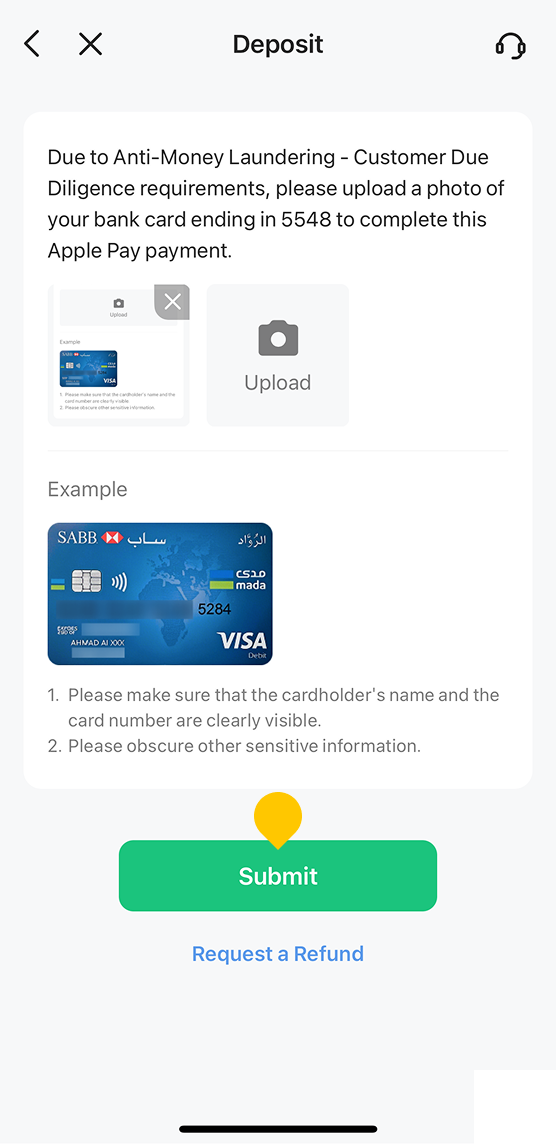

During the Apple Pay deposit process, Customer Due Diligence (CDD) verification may be required. Please follow the steps below to complete the verification:

1. Upload a photo of your bank card. The uploaded photo must clearly show the cardholder's full name and the last four digits of the card number, while obscuring the CVV and all other parts of the card number.

2. Tap "Submit" to initiate the deposit.

Refund Policy:

1. Conditions Triggering a Refund:

- If you are required to upload bank card information for CDD verification and fail to do so within the specified timeframe, a refund will be initiated.

- A refund will be issued to the source account if stolen or unauthorized payment methods are used.

- A refund will be issued to the source account if a third-party debit or credit card is used to make a deposit.

2. The refund process may take up to 5 business days. Please note that processing times may vary depending on your bank. Additionally, an extra fee may apply.