Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Marketing Home Group for Trading Co.: The daily gain is 9.0%, Strong performance boosts investor confidence in Marketing Home Group.

BUILD STATION 4194.SA | 59.50 | +8.97% |

ALRAMZ 4327.SA | 68.75 | +6.42% |

BUPA ARABIA 8210.SA | 164.80 | +5.64% |

EIC 1303.SA | 13.44 | +4.11% |

EAST PIPES 1321.SA | 151.60 | +3.84% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

At the close of 28/01/2026, the Tadawul All Shares Index rose by 0.67%, closing at 11458.11 points; the Parallel Market Capped Index rose by 0.44%, closing at 23855.01 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

Marketing Home Group for Trading Co.: The daily gain is 9.0%, Strong performance boosts investor confidence in Marketing Home Group.

In a noteworthy development, the possible reason for the stock price increase of 4194.SA (Marketing Home Group for Trading Co.) may be attributed to its strong recent performance. The stock has experienced a significant daily gain of 9.0%, indicating robust short-term momentum. This surge has contributed to an impressive year-to-date increase of 10.0%, suggesting sustained investor confidence. The consistent upward trajectory could be attracting more buyers, further driving the stock's price appreciation. Market sentiment towards the company or its sector may also be favorable, potentially fueling the positive price movement.

Alramz Real Estate Co.: The daily gain is 6.4%, Strong market performance driven by strategic investments, property demand, and economic growth.

In a noteworthy development, the possible reasons for the stock price increase of 4327.SA (Alramz Real Estate Co.) may be attributed to several factors. The company's shares surged 6.4% in a single day, indicating strong investor confidence. This surge contributes to an impressive year-to-date gain of 26.6%, suggesting sustained positive momentum. The robust performance could be driven by favorable market conditions in the Saudi Arabian real estate sector, potential company-specific developments, or broader economic factors benefiting the industry. Investor optimism and speculation may also play a role in the stock's upward trajectory.

Bupa Arabia for Cooperative Insurance Co.: The daily gain is 5.6%, Robust growth potential despite recent earnings dip. Positive long-term outlook.

Bupa Arabia for Cooperative Insurance, operating under the ticker symbol BUPA on the Saudi Stock Exchange (Tadawul), has been publicly traded since May 2008. The company specializes in life and health insurance within the broader insurance sector. Headquartered in Jeddah, Saudi Arabia, Bupa Arabia commenced operations in May 2008, focusing on providing comprehensive insurance solutions to the Saudi market.

In a noteworthy development, the possible reason for the stock price increase of 8210.SA (Bupa Arabia for Cooperative Insurance Co.) may be attributed to several factors. The company's stock surged 5.6% in a single day, contributing to an impressive year-to-date gain of 18.6%. This robust performance aligns with the overall upward trend in the insurance sector. Additionally, the Saudi cabinet's approval of a national insurance industry strategy on January 20th may have bolstered investor confidence. Despite a 12% earnings decline in the past year, Bupa Arabia's strong three-year EPS growth of 59% and analysts' projections of 14% annual EPS growth over the next three years have likely fueled positive sentiment. The stock's current P/E ratio of 21.6x, exceeding about half of the Saudi Arabian market, suggests investors are willing to pay a premium for its growth prospects.

Electrical Industries Co.: The daily gain is 4.1%, Strong financial results and market growth drive positive outlook for the company.

EIC, a publicly traded company on the Saudi Stock Exchange since December 2014, operates in the Capital Goods sector with a focus on Electrical Components and Equipment. Headquartered in Dammam, Saudi Arabia, the firm was founded in August 2007. EIC's shares are traded under the ticker symbol TDWL on the Tadawul exchange.

In a noteworthy development, the possible reasons for the stock price increase of 1303.SA (Electrical Industries Co.) may be attributed to its strong market performance and positive momentum. The company ranks 9th among long-term strong stocks in the Saudi market, boasting a high composite score of 85.83 and an impressive RPS score of 97.57. Operating in the Capital Goods sector, 1303.SA has demonstrated robust growth with a 4.1% daily gain and a 20.0% year-to-date increase. Its inclusion in the TOP30 watchlist and substantial market capitalization of 14.95 billion Saudi Riyals further underscore investor confidence in the company's prospects.

Nahdi Medical Co.: The daily gain is 3.8%, the stock price has risen.

Nahdi Medical Co., trading under the ticker NAHDI on the Saudi Stock Exchange (Tadawul) since March 2022, operates in the Drug & Food Retail sector with a focus on Drug Retail. Established in June 1986 and headquartered in Jeddah, Saudi Arabia, the company has become a significant player in the pharmaceutical retail industry within the Kingdom.

It is worth noting that the daily gain of Nahdi Medical Co.(4164.SA) is 3.8%, and the year-to-date gain/loss is 3.9%.

East Pipes Integrated Company for Industry: The daily gain is 3.8%, Secures major contracts and reports robust Q3 performance.

East Pipes Integrated Company for Industry (EAST PIPES) is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since February 2022. The company specializes in pipeline and storage solutions within the energy, oil, and gas sector. Headquartered in Dammam, Saudi Arabia, EAST PIPES was founded in May 2010 and has established itself as a key player in the industry.

In a noteworthy development, the possible reason for the stock price increase of 1321.SA (East Pipes Integrated Company for Industry) may be attributed to several positive factors. The company recently secured two significant contracts: a steel pipe coating application contract with AliShar Contracting Company valued at over 60 million Saudi Riyals, and another contract with Abdullah Ibrahim Al-Sayegh & Sons worth over 40 million Saudi Riyals. Additionally, East Pipes reported strong financial performance, with Q3 2025 net profit increasing by 42.3% year-on-year to 160 million Saudi Riyals and sales revenue growing 21.37% to 641 million Saudi Riyals. The company's nine-month results for 2025 also showed impressive growth, with net profit up 37.87% and sales revenue increasing by 11.47%. These factors, combined with improved operational efficiency and higher average selling prices, likely contributed to the stock's 3.8% daily gain and 9.6% year-to-date increase.

The Company for Cooperative Insurance: The daily gain is 3.7%, Tawuniya's outlook improves as Saudi insurance strategy enhances market potential.

The Company for Cooperative Insurance, commonly referred to as Tawuniya, is a publicly traded entity listed on the Saudi Stock Exchange (Tadawul) since 2005. Operating in the insurance sector, Tawuniya specializes in multi-line insurance products. Headquartered in Riyadh, Saudi Arabia, the company was founded in 1986 and has since established itself as a prominent player in the regional insurance market.

In a noteworthy development, the possible reasons for the stock price increase of 8010.SA (The Company for Cooperative Insurance) may be: The Saudi cabinet's approval of a national insurance industry strategy, aimed at making Saudi Arabia one of the fastest-growing insurance markets globally. This initiative is expected to significantly benefit Tawuniya, a leading player in the sector. The strategy's ambitious 2030 goals, including increasing insurance penetration to 3.6% of GDP, present substantial growth opportunities for the company. Additionally, Tawuniya's new reinsurance contract with Saudi Reinsurance Co. for potential defect projects has likely bolstered investor confidence. The stock's impressive 19.5% year-to-date gain and its position as a top performer in the Saudi market this week further underscore the positive sentiment surrounding the company.

Saudi Vitrified Clay Pipes Co.: The daily gain is 3.5%, gains from infrastructure projects and economic recovery in Saudi Arabia.

Saudi Vitrified Clay Pipes (SVCP) is a publicly traded company listed on the Saudi Stock Exchange (Tadawul) since 2007. Operating in the Capital Goods sector, SVCP specializes in industrial machinery. The company, founded in 1978, is headquartered in Riyadh, Saudi Arabia. SVCP has established itself as a significant player in the vitrified clay pipe industry.

In a noteworthy development, the possible reason for the stock price increase of 2360.SA (Saudi Vitrified Clay Pipes Co.) may be attributed to several factors. The company's shares rose 3.5% on the day, contributing to a year-to-date gain of 12.5%. This upward trend could be driven by Saudi Arabia's ongoing infrastructure projects, which may boost demand for vitrified clay pipes used in sewage and drainage systems. Additionally, the stock's performance may reflect broader economic recovery in the Kingdom, as well as positive sentiment towards the industrial sector. The company's position in the Capital Goods sector might also benefit from government initiatives aimed at economic diversification under Vision 2030.

Alinma Bank: The daily gain is 3.2%, Reports robust growth and announces plans for capital expansion to support future development.

Alinma Bank, a diversified banking institution, has been publicly traded on the Saudi Stock Exchange (Tadawul) since June 2008. Headquartered in Riyadh, Saudi Arabia, the bank was founded in May 2008. It operates within the banking sector, offering a range of financial services. Alinma Bank's presence on Tadawul underscores its significance in the Saudi financial landscape.

In a noteworthy development, the possible reasons for the stock price increase of 1150.SA (Alinma Bank) may be: 1. Strong financial performance, with a 9.7% rise in net profit to 6.437 billion Saudi Riyals for 2025. 2. Robust operational growth, as total operating income increased by 8.82% to 11.905 billion Saudi Riyals. 3. Significant asset expansion, with total assets growing 12.37% to 311.067 billion Saudi Riyals. 4. Improved shareholder value, as earnings per share rose from 2.22 to 2.37 Saudi Riyals. 5. Proposed 20% capital increase through bonus shares, signaling confidence in future growth. 6. Strategic capital expansion plan from 25 billion to 30 billion Saudi Riyals, using reserves and retained earnings. 7. Positive market sentiment, reflected in the stock's year-to-date increase of 15.9%.

Dar Al Majed Real Estate Co.: The daily gain is 3.0%, Announces Board Nominations for 2026-2030 Term

In a noteworthy development, the possible reason for the stock price increase of 4326.SA (Dar Al Majed Real Estate Co.) may be linked to the company's announcement of board nominations. The firm disclosed plans to open nominations for a new board of directors, set to serve from 2026 to 2030. This move, signaling corporate governance transparency and long-term planning, likely boosted investor confidence. The proposed nine-member board structure and emphasis on regulatory compliance further underscored the company's commitment to sound governance practices. The 3.0% daily gain, contrasting with a 2.3% year-to-date decline, suggests a potential short-term recovery in investor sentiment towards the stock.

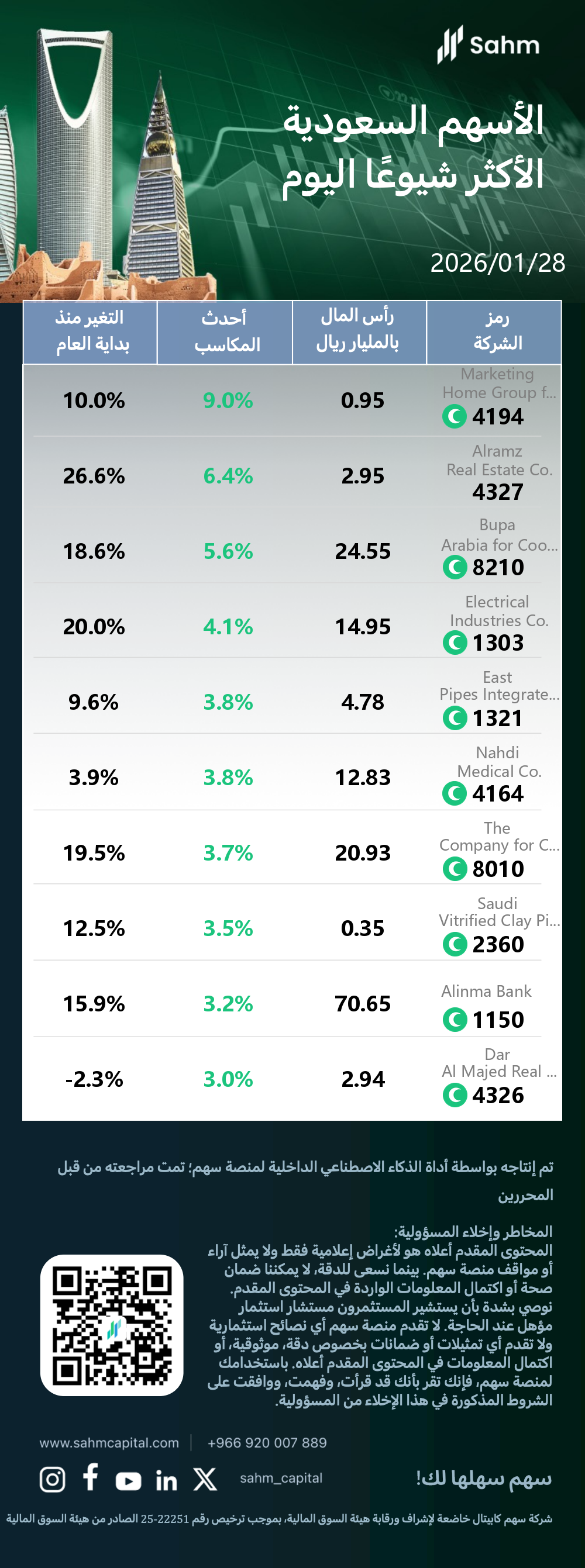

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| 4194.SA | 0.95 | 9.0% | 10.0% |

| 4327.SA | 2.95 | 6.4% | 26.6% |

| 8210.SA | 24.55 | 5.6% | 18.6% |

| 1303.SA | 14.95 | 4.1% | 20.0% |

| 1321.SA | 4.78 | 3.8% | 9.6% |

| 4164.SA | 12.83 | 3.8% | 3.9% |

| 8010.SA | 20.93 | 3.7% | 19.5% |

| 2360.SA | 0.35 | 3.5% | 12.5% |

| 1150.SA | 70.65 | 3.2% | 15.9% |

| 4326.SA | 2.94 | 3.0% | -2.3% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team. Risk and Disclaimer: The content provided above is solely for informational purposes and does not represent the views or positions of Sahm Platform. While we strive for accuracy, we cannot guarantee the authenticity or completeness of the information contained in the provided content. We strongly recommend that investors consult with a qualified investment advisor when deemed necessary. Sahm Platform neither provides investment advice nor makes any representations or warranties concerning the accuracy, reliability, or completeness of the information in the content provided above. By using Sahm Platform, you acknowledge that you have read, understood, and agreed to the terms set forth in this disclaimer.